The war in Ukraine had a significant impact on the global economy in 2023.

The ongoing conflict has led to increased geopolitical tensions, which in turn have disrupted international trade and investment flows. The uncertainty surrounding the situation has caused market volatility and decreased investor confidence. However, the situation could have been much worse.

“Contrary to some projections, the world dodged a major recession in 2023,” says economics Prof. Niaz Asadullah. “Still, the global economy is facing issues – external shocks such as extreme weather and geopolitical upheaval are combining to make a full recovery slow, uneven and uncertain.”

This is because the war has disrupted key supply chains, particularly in the energy sector, as Ukraine is an important transit country for natural gas exports from Russia to Europe. This has resulted in higher energy prices and increased costs for businesses and consumers worldwide. The war's impact on the global economy is far-reaching and continues to be a cause for concern among policymakers and economists.

A stressful time for raw material sourcing.

Alongside the restrictions to trade through the Black Sea, the war has also been a major disruptor to the supply of commodities and raw materials that the two sides provided the global economy.

Most notably, Russia was among the world’s largest exporters of:

· natural gas

· fertilisers

· crude oil

· gold

· grains

· cobalt

· palladium

· nickel

· aluminium

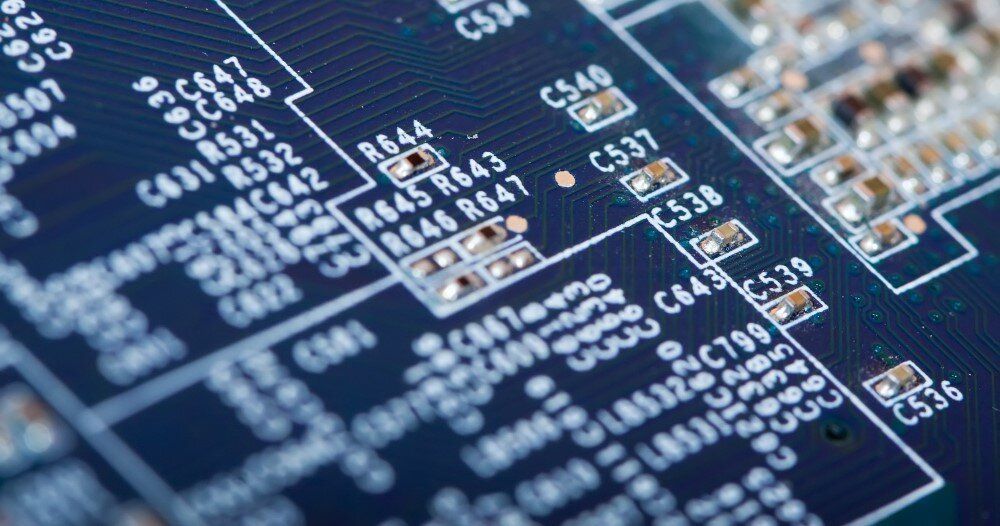

Another major limitation imposed by the conflict was on the supply of neon, which is required for lasers and chip manufacturing. About 70% of the neon used worldwide and 90% of the semiconductor-grade neon used in the US are produced in Ukraine. When the fighting started, the two biggest Ukrainian suppliers—who combined produce half of the world's neon—were forced to close. Additionally impacted was the supply of xenon and krypton, both of which Ukraine exports in large quantities.

In addition to these vital commodities, when Russia invaded Ukraine the two countries combined accounted for 29% of global wheat exports and 75% of global sunflower oil. Ukraine was by itself the world's largest exporter of sunflower oil and the fourth-largest exporter of maize and wheat.

Financial and raw material problems in Russia.

Despite accumulating a sizeable war chest prior to the invasion and with an increasingly close trading relationship with China, the Russian manufacturing sector must certainly be feeling the heat.

The war has gone on considerably longer than anyone expected, the need for Russian mobilisation has resulted in a ‘brain drain’ of fighting age men fleeing the country, while the casualty list of dead and wounded of more than 315,000 also carries an enormous economic price tag of lost labour.

At the same time, sanctions and export controls are damaging Russia’s economy and limiting its access to the global banking system. This is restricting access to finance and investment, as well as blocking access to the raw materials and high-tech goods needed to wage a modern war and provide economic growth.

As a UK Treasury report states, “While Russia has the resources to maintain its war in the short-term, its leaders face increasingly painful trade-offs that will sacrifice long-term prospects — as underinvestment, slow productivity growth, and labour shortages will only deepen.”

Sanction breaking.

Much to the concern of many Western politicians, most of the world is not participating in the sanctions and embargoes imposed by the EU and US.

India, for one, has actually increased its trade by taking advantage of discounted oil from Russia. A deal that led the US to warn India that there might be ‘consequences.’ Even Saudi Arabia is now importing the discounted oil, as Moscow (desperate for foreign income) slashes its oil prices to replace lost revenue now that its long-term customer (the EU) has closed the pipes. It is also worth noting that not a single country in Africa or the Middle East has imposed major sanctions on Russia.

War is damaging the global economy, but is this just a return to normal?

The war has been highly disruptive for financial markets and commodity prices, with energy, metals, and grains being the worst hit. This has had a profound impact on the global economy, with the US Federal Reserve stating that “the war has reduced the level of global GDP by about 1.5 percent and has led to a rise in global inflation of about 1.3 % points. The negative effects of geopolitical concerns manifest as decreased consumer confidence, rising commodity prices, and tighter financial conditions.”

However, some scholars have argued that the state of uncertainty that the global economy has experienced over the last 20 years (the US sub-prime mortgage market collapse of 2008, the rocketing growth of Asian ‘Tiger’ economies, the COVID health pandemic, the supply chain logjam, and now the war in Ukraine) are all part of a return to business as normal in an economically chaotic world.

As Raúl Castaño Urueña of the University of Madrid explains, “When there were only two superpowers the parties feared and negotiated with each other. By doing so, they lessened the degree of uncertainty as issues were common or shared and clearly visible on the surface. Now there are many players in an anarchical international system and each party strives for its own interests or needs that they turn into a strategy. Thus, with that in mind, it is impossible to control or calculate any macro political or economic processes. Scarce resources push players to strive to get a product earlier than another. Hence, states play individual games in order to pursue political interests.”

If true, then the sense of business chaos and the disruption to supply chains and raw material trading is something that we should expect more of. It is the natural order of the world that was only becalmed during the Cold War.

But that is all just academic theory, and of little concern to the manufacturers who are struggling to procure the raw materials that they need.

Now, as we look deeper into 2024 with little sign of peace in Ukraine, businesses should be thankful that the global economy did not fall into a global depression as many predicted would happen when the war began. Furthermore, the limited exports of foodstuffs from the region have not forced starvation among the world’s poorest.

Yet still, the war continues to resound across supply chains and global markets.

As Prof. Jean Pisani-Ferry, a Senior Fellow at the Bruegel European think tank, notes, “The invasion of Ukraine is a watershed. Whatever the duration of the war, its legacy will be long-lasting. It will shape Europe’s policy choices for the years and decades to come.”

To learn more on this topic, read: The Ukraine War’s Impact on the Economy and Raw Material Prices or Is Europe’s Chemical Industry Starting a Decades’ Long Recession?

Photo credit: Freepik, jcomp, Travelscape, bearfotos, Freepik, & kjpargeter