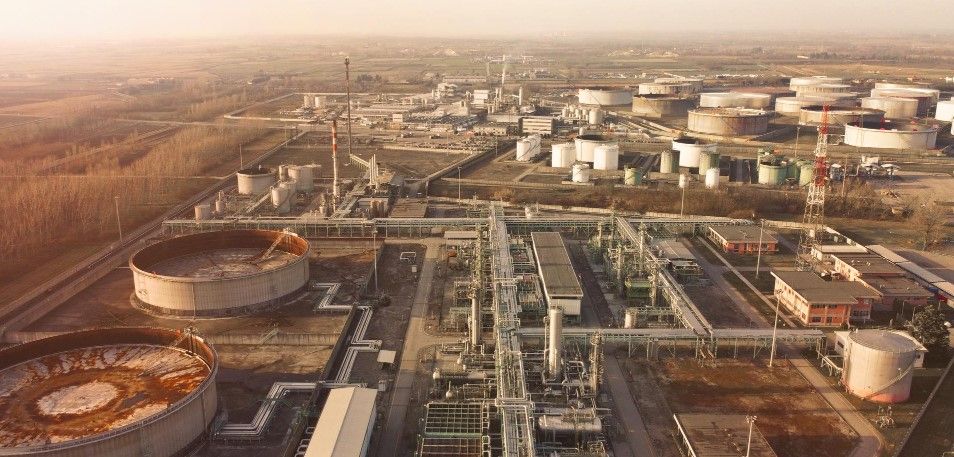

The effective movement of goods is an essential part of the interconnected chemical industry. Being able to efficiently transport a chemical ingredient from a chemical facility in one country to a production plant in another before moving the final chemical product for sale in a third country is a vital part of how the global economy operates.

If costs run too high, if the risks become too great, or if chemicals are too severely affected by transportation, then the deal is off and both chemical businesses and consumers suffer.

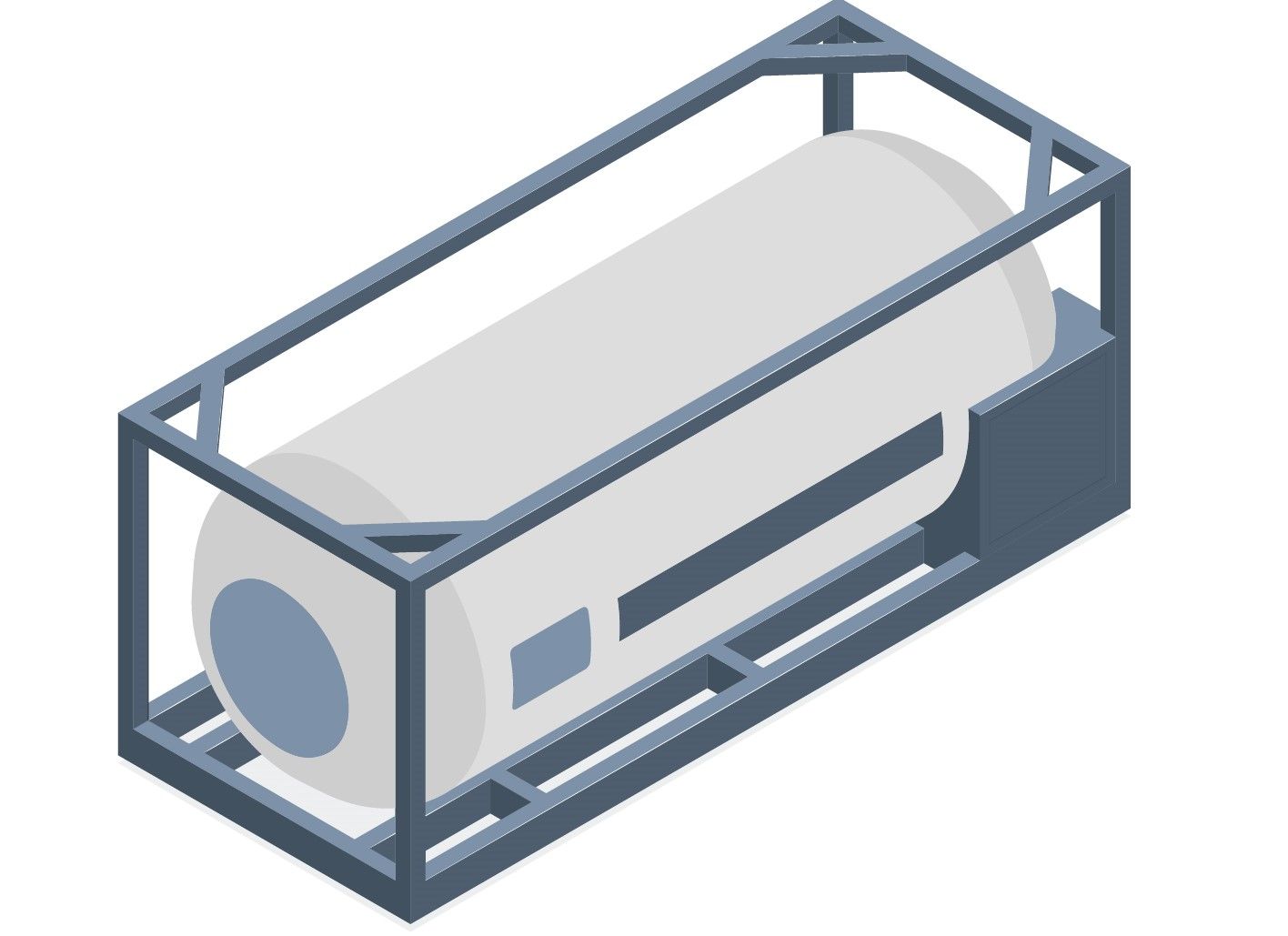

In this respect, ISO Tank Containers should be seen as an invention that has revolutionised the global economy and transformed the transportation of gases and liquids – from danger to safety and from pricey to affordable.

However, under their modest exterior, transporters and logistics specialists face a world of particular difficulties.

As Steve Lonsdale, Global Operations Director at Suttons International, noted in a recent interview at the end of November 2023 when he stated that, “The tank container industry has been abuzz with concerns over limited depot and cleaning capacity in various regions. This growing concern can be attributed to a combination of factors, including the rapid expansion of the global tank container market, labour shortages, economic challenges, and legislative changes.”

The world has witnessed rapid growth in the tank container market over the last ten years, with the global count more than doubling from 338,000 to over 800,000 units. While ISO tank containers are durable and resilient, they do still require a certain level of maintenance and a considerable amount of cleaning. This is particularly true if toxic or hazardous chemicals have been transported. The rise of tank container maintenance and cleaning depots as well as storage facilities, however, has significantly failed to keep pace with the sheer number of containers in use.

These challenges have been most widely felt since the global health pandemic which caused a logjam at ports, a labour shortage, and the clogging of storage deports and cleaning facilities for containers.

While the recent economic slowdown has gone some way to restore normality to the market for ISO tanks, the lack of facilities combining with the increased numbers is creating great challenges for logistics teams and supply chain managers.

Lonsdale believes that unless the situation is alleviated then the consequences could include, “… the possibility of depot selectiveness, where depots favour easy cleans and light maintenance work, over more time-consuming activities. Slowing equipment turnover and a shift in focus on quantity over quality could lead to a decline in overall standards and performance.”

As a report from the industry journal Bulk Distributor notes, “In general there has been a large-scale migration of bulk liquids transported by parcel tankers to liquids in ISO containers of various types.”

While many logistics companies have invested in plastic flexitanks (their numbers have more than tripled between 2011 and 2020) there long-term use could be in doubt over their lack of sustainability and their end-of-life disposal as a plastic container.

“Cargo owners are increasingly uncomfortable about shipping product in a flexitank, [as they] represents about 40kg of plastic, equivalent to roughly 7,000 shopping bags,” explains William Leigh-Pemberton, the Strategic Development Director at Bertschi, and Chair of the ITCO Operators’ Division. “In theory, recycling is possible but the efficacy of this is coming into question. A key message from the COP26 conference was that rather than looking to recycle plastics, society should move faster towards their non- consumption in the first place.”

The key result of the issues surrounding the supply of industrial chemicals and raw materials, such as low-emission transportation, localized sourcing, supply shortages, sustainability and recyclability of packaging and containers, has been for chemical companies to acknowledge the value of consistent and reliable delivery. The situation has shown the value of efficient supply chain management.

“What has definitely happened,” says Leigh-Pemberton, “is that suppliers, whether of manufactured goods or logistics services, have seen their status elevated from a dispensable supporter in an over-capacity environment to that of valued partners acknowledged for being indispensable.”

“Competently executing logistics chains in a safe manner that protects the reputation of all involved has been working in the background for many years,” he adds. “But now this is being recognised as something of value – and something that costs.”

The lack of due care and attention to ISO tank containers is a key part of the issue.

“Operators should appreciate the ongoing supply chain challenges,” says Mike Yarwood, the managing director of loss prevention at the global logistics insurer the TT Club. “Prioritising tanks for cleaning once empty/ dirty, considering inspections to see whether pickling or passivation is required, and to continue due diligence checks on the shipper and the cargo to be shipped.”

Resolving these issues will require long-term vision and investment from both government and private industry. Together they can increase storage capacity, reduce traffic, and enhance working conditions in order to draw and keep qualified workers. At the same time, an increase in total tank storage capacity, improved cleaning efficiency, strategic planning, infrastructural development, and operational practise improvements are required.

While some investors have expressed interest in the depot and cleaning industry, it is unclear how these investments will affect standards, pricing, capacity, and efficiency. Particularly, as new enterprises focus on profitability and not the industry-wide overhaul of operations that the chemical industry is looking for in the issue of ISO tanks. As a result, such investments are only likely to alleviate the issue in highly crowded regions, such as Singapore.

Tank container industry capacity constraints are a complex problem with wide-ranging effects. To address the issue and guarantee the long-term expansion of this crucial business, a trifecta of government assistance, industry cooperation, and strategic planning is needed.

However, just how this can be achieved when the chemical industry is facing the challenges of sustainability, carbon-emissions targets, and the supply chain issues caused by Russia’s invasion of Ukraine remains to be seen.

Photo credit: Macrovector official on Freepik, Andreas, Wikimedia, Wallpaperflare, & Wikimedia