With the war in Ukraine now lasting for almost two months, the impact of lost production is truly being felt by manufacturers around the world. Yet to give an insight into how badly industry and supply chains in Ukraine have been hit, here are two snapshots into the plight of the Ukrainian economy.

Interpipe is a classic example of how quickly production in Ukraine came to a halt when the Russian invasion began.

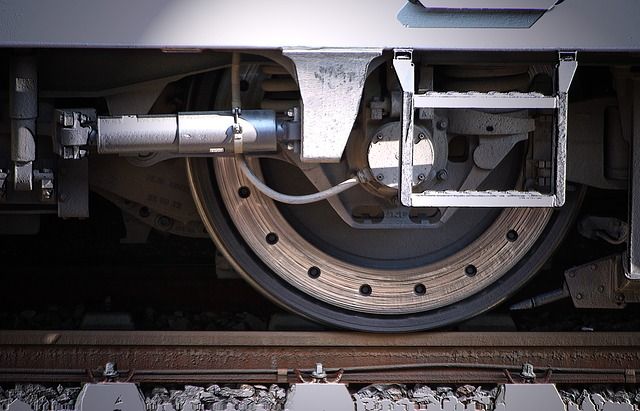

The business was a well-established manufacturer of steel transmission pipes for oil with a customer base of companies in Texas. It also produces high-speed railway wheels for different train operators in Europe. But all five of the company’s factories were closed as soon as fighting began, as the entire production centre is located in the Dnipro industrial hub - a militarily strategic region on the Dnieper River, southeast of Kyiv.

The invasion began before dawn on February 24th and by lunchtime on the same day production was being wound down.

“It was a hard choice to stop production,” says Andrey Bibik, who managed the 24-hour operation at one of Interpipe’s steel plants. “We had plenty of orders, a lot of customers awaiting our material. But if you have to choose between safety, and possible profits, I think the answer is obvious.”

In total, the company sent home almost all of its roughly 10,000 employees, leaving only a skeleton crew to keep the place secure and to make metal roadblock obstacles for enemy tanks. Some have joined the army to help fight the Russians, others have left as refugees. All the workers are still being paid.

The plant closures will clearly have a knock-on effect on other industries in other parts of the world. As ABC News reports, “Interpipe’s customers in the energy and rail industries typically order their pipes, wheels and other products months in advance, but … the disruptions will cause shortages and lead some to look for alternatives. For some wheel customers, such as a Saudi Arabian railway operator, Interpipe is the sole supplier. Two of the company’s chief steel industry rivals, OMK and Evraz, are in Russia and he hopes customers will avoid them.”

While steel can be sourced from other places, Ukraine’s wealth of natural resources may be harder to replicate. For example, the country is one of the world’s largest suppliers of neon.

Famously used to make lighted neon advertising signs, as an industrial gas, neon is also used in the fracking industry (to help detect leaks), in plasma TVs, as a coolant in the aerospace industry, in the production of high-powered lamps, in diving equipment, and most significantly, in making lasers.

Demand for lasers has grown in recent months, as they are used to etch integrated circuits onto computer chips. With the world, and specifically the automobile industry, already experiencing a shortage of microchips, a lack of neon may create further supply chain bottlenecks.

Ukraine accounts for only about 0.3% of global exports, but while the total number may be small, the impact of lost output can be significant. If sanctions and company boycotts of trade with Russia are included, then manufacturing and raw material supply is being dealt a double blow, just as recovery was getting underway.

The global economy will recover one day, but on a personal level the heartbreak of the war will be everlasting.

“I don't know if our business will survive," says Interpipe’s Bibik. “We do all that's necessary to support the people, to keep our employees, to be able to restart in a month or two or three, whenever things get back to — at least closer to — normal. But in reality, nobody can predict what's going to happen.”

The ongoing conflict is hurting both manufacturing and raw material supplies.

Photo credit: Kateryna Babaieva, PIRO4D from Pixabay, & PublicDomainPictures