The coronavirus pandemic and its subsequent economic lockdowns have brought difficult times for chemical companies everywhere.

While all chemical company executives are planning for a quick and strong recovery, some firms are better placed than others. One such enterprise is Albemarle Corporation.

At first glance, the 132-year old, North Carolina-based company may seem as exposed as every other chemical business to the ups and downs of the wider chemical industry.

However, the company seems to be in a strong position to ride out the short storm that is the COVID recession.

As the investment journal Seeking Alpha reports, “Albemarle has made no pretence that COVID-19 will have no effect on its operations in the short term. Expansion projects in Australia and Chile have been reined in, and ahead of Q1 2020 stated that Q1 in China would be weak due to coronavirus. Much of Albemarle's processing facilities are located in China, and 13% of Albermarle's revenue is derived from China, so this was far from ideal. And while Q1 2020 revenue of $738.85 million missed estimates by $30.26 million, earnings per share of $1.10 for the same quarter beat estimates by $0.16.”

But upon closer examination, it becomes apparent how the firm is even better positioned to benefit from longer-term trends. This is because, while present global attention is on COVID-19, rioting in America, economic recession, and the upcoming US presidential election, the overriding focus for the next decade will be on climate change and the environment.

This will increase consumer priorities for environmentally friendly products and a predicted wave of legislation passed by governments to improve air and water quality, restrict emissions, and increase sustainability.

Part of those improvements includes electric vehicles. As Elmer Kades, a managing director with the consulting firm AlixPartners, states, “Electrification, you cannot stop it anymore — it's coming.”

Consequently, sales of electric cars are due to surpass sales of internal-combustion-engine vehicles by 2030. To achieve this, more than 1 billion eletric cars must be manufactured over the next ten years.

Electric vehicle batteries contain a high quantity of lithium. According to Aaditya Tiwari, a research and development engineer, each KWhr of power requires 0.12 – 0.15 kg of lithium. Although some electric car battery designs use even more. For example, a Tesla battery uses about 0.17 kg of lithium per KWhr. This means that a 70kWh Tesla battery contains approximately 63kg of lithium carbonate Li2CO3, of which 19% or 12kg is lithium.

One billion cars each requiring 12 kg of processed lithium leaves Albemarle, the world leader in the lithium mining and processing sector, exceptionally well-placed.

At present, desire for expansion of lithium extraction is low. As Vincent Mascolo, the chief executive at the gold and lithium exploration company Ironridge Resources, noted, “We don't want to spend a great deal on lithium at the moment...Investor appetite is not there.”

However, the potential in the medium and longer term is enormous.

The Seeking Alpha report specifically noting the breakdown of Albemarle’s revenues in 2019. During which the company derived incomes mostly from lithium, bromide specialties, and catalysts. Specifically earning 37%, 28% and 29% respectively of its total income was made in these markets.

However, while bromide specialities and catalysts accounted for only 2% and 3% of chemical industry growth in 2019. Lithium was responsible for a massive 20% of last year’s industry expansion.

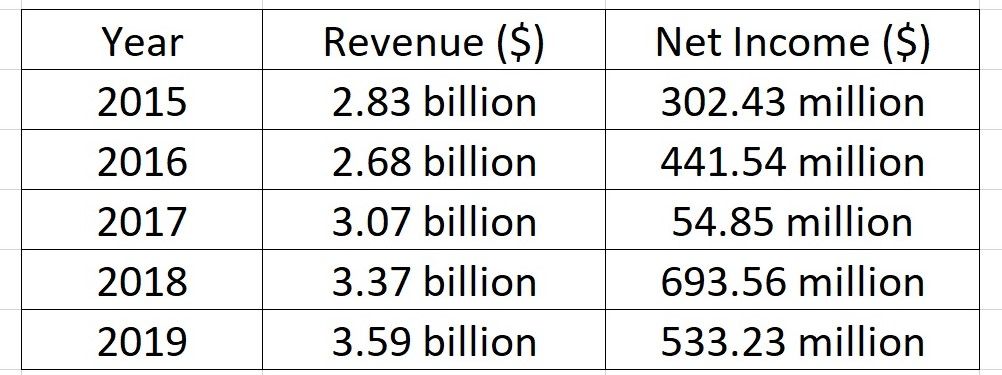

This has helped the company achieve healthy growth in both revenue and income during recent years. As these figures from Albemarle Corp.'s investor relations page show.

By the end of this decade, electric vehicles will hold a 51% market share of the automobile industry, and lithium processors and raw material suppliers will profit.

Consequently, Albemarle is well placed to beat the COVID recession and hail a decade of robust recovery.

Photo credit: cebbi from Pixabay, MikesPhotos from Pixabay, Craig Adderley from Pexels, facebook, & Markus Spiske from Pexels