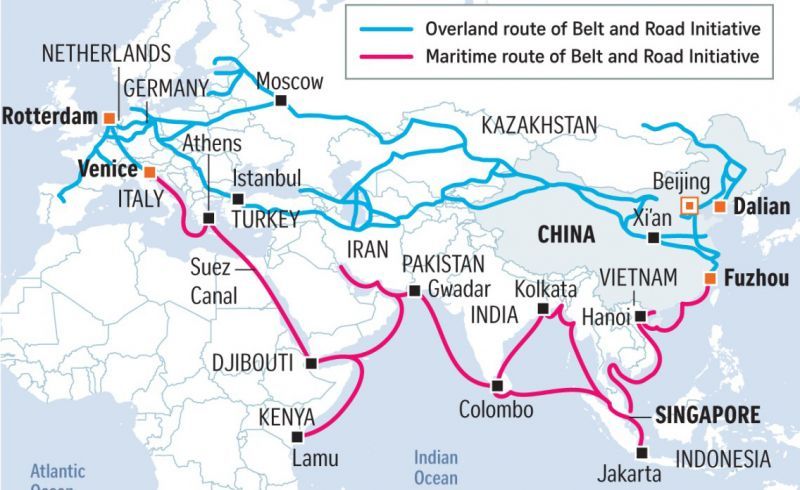

The Belt and Road initiative (BRI) is a massive infrastructure project announced in 2013 as a plan to forever change global chemical markets and the way China trades with the rest of the world.

This is the second part of this story on China's Belt and Road Initiative and it's impact on the chemical industry. You can read Part 1 here.

The numbers behind the project are huge, as the World Bank reports, “In 2017, the 71 economies [geographically located along BRI transport corridors] received 35% of global foreign direct investments and accounted for 40% of global merchandise exports.” Additionally, the costs of these projects, excluding those in China, “… are estimated to amount to US$575 billion.”

Adding that, “If completed, BRI transport projects could reduce travel times along economic corridors by 12%, increase trade between 2.7% and 9.7%, increase income by up to 3.4% and lift 7.6 million people from extreme poverty.”

But while such massive sums of money being spent on infrastructure will have a positive effect on the economies of those in the path of the Belt and Road, does China have the money, commitment, and ability to complete the world’s largest infrastructure project?

Can China afford a project as ambitious as Belt and Road?

With such an enormous multinational project spread over thousands of miles, estimates of total costs vary widely, with figures in the region of $4 - $8 trillion.

Certainly it is clear that money is being spent, as the Economist reported in 2016, “In April a Chinese shipping company, Cosco, took a 67% stake in Greece’s second-largest port, Piraeus, from which Chinese firms are building a high-speed rail network linking the city to Hungary and eventually Germany. In July work is due to start on the third stage of a Chinese-designed nuclear reactor in Pakistan, where China recently announced it would finance a big new highway and put $2 billion into a coal mine in the Thar desert. In the first five months of this year, more than half of China’s contracts overseas were signed with nations along the Silk Road—a first in the country’s modern history.”

Some question whether China hasn’t bitten off more than it can chew with the Belt and Road. An enterprise so large that China with its relatively low GDP per capita simply cannot afford.

John Richardson, Asia Consultant for ICIS, believes that China’s long-term position means that it has to act, and complete the new trade route, urgently. With tension increasing over trade tariffs, America has begun to attack China’s access to technology. Tired of watching Chinese companies produce high-end products such as cars and computers, the US is trying to stop the flow of technology. Starting with Huawei which it is ‘trying to almost push out of business’.

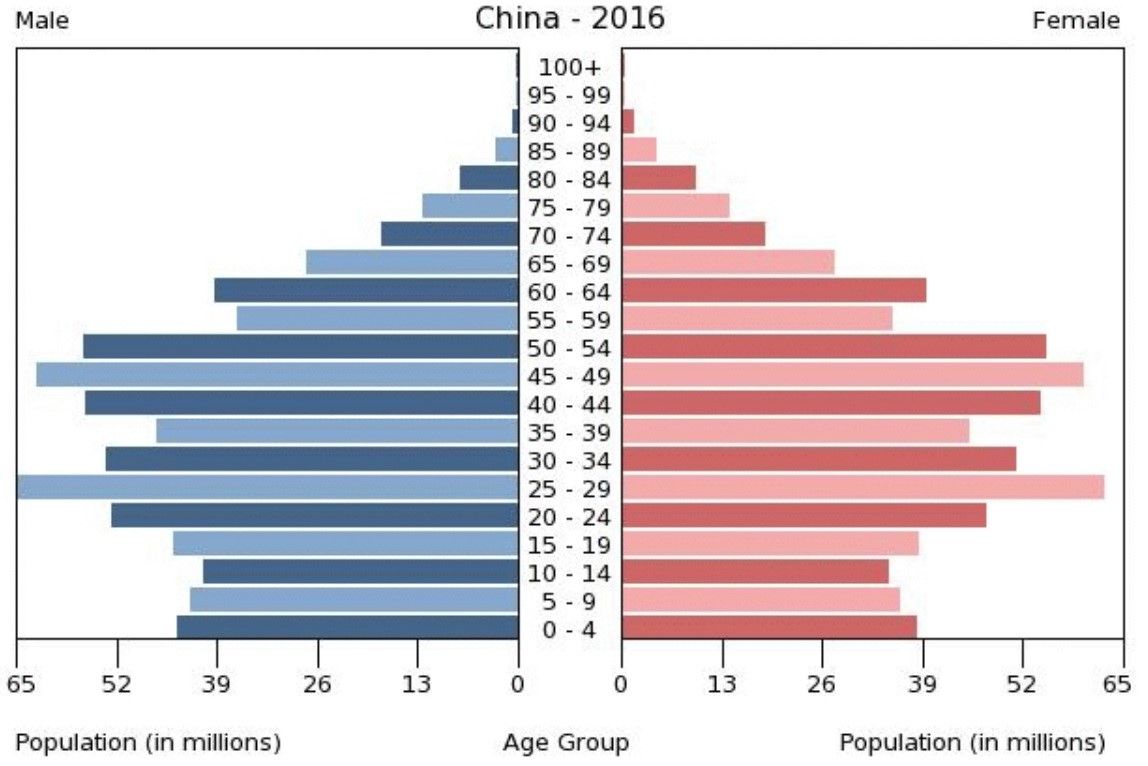

In response, China is being forced press on quickly with completion of the Belt and Road, not over generations (as originally planned) but much sooner, so that it is able to trade more easily with Central Asia, the Middle East and beyond. Here Richardson is quick to highlight, China’s ageing population, a product of the ‘one child policy’ which saw families with six children in the 1960’s fall away to just one in the 1970’s. This has left the country with some misshaped demographics, and the problems that can incur. Without increased trade, China will not be able to support its future pensioners and healthcare costs.

The answer is to use the Belt and Road to outsource manufacturing. As Richardson made clear in a recent ICIS podcast, explaining how, “Because China’s population is ageing they want to move clothing manufacturing to Iran which has a very young population and where the wages are very low, to make cheap clothes. That clothing factory will then be supplied with polyester fibre from China. China makes polyester, but it is short of paraxylene. So, China will invest and buy an oil refinery in Iran to make paraxylene which it will send to China to make the polyester fibre to be send back to Iran to make clothes. All of which depends on a functioning Belt and Road.”

A recent report by consultants at McKinsey noted other examples of labour outsourcing, noting that, “Samsung moved many tens of thousands of jobs to Vietnam from China years ago. Li & Fung’s textile supply chains have a centre in Bangladesh.”

While Richardson further adds that, “China also has a problem with food, with much of its agricultural land polluted with heavy metals. The Belt and Road can help connect China with a country like Tanzania, where investment in agriculture can provide China with food. The Belt and Road has to succeed if the Chinese economy is to remain healthy.”

This makes the Belt and Road project a necessity, not just for the future of China’s chemical industry, not just in any ongoing trade wars, but for economic survival. As such, we should question not if China can afford to build the Belt and Road, but whether China can afford not to?

Photo credit: McKinsey, Worldbank, Asiagreen, Chinadaily, Brookings, Xinhuanet, MSNIndexmundi, Unitedglobalasset, & Chinacheckup