All chemical industry analysts know of the importance of the American Chemical Council’s data report as a barometer of the health of the chemical industry. However, what can it tell us about the ongoing trade war with China?

Looking at the ACC data, the typically positive U.S. Chemical Production Regional Index (U.S. CPRI) which compares chemical output year on year, perhaps shows that the industry is experiencing a bump in the road. As the ACC reported on Sept 6th 2019, “The U.S. CPRI fell by 0.9 percent in July following revised declines of 0.8 percent in June and 0.6 percent in May.”

Adding that, “Chemical output was lower in all regions, with the largest declines in the Mid-Atlantic, Northeast and West Coast regions.”

While it must be acknowledged that there was an increase in output for chlor-alkali and other inorganic chemicals. The report explains that, “These gains were offset by declines in the output of pesticides, synthetic rubber, coatings, fertilizers, consumer products, plastic resins, organic chemicals, synthetic dyes & pigments, adhesives, manufactured fibers, and other specialty chemicals.”

How much of this downturn is due to the trade war is impossible to say; however, the war is threatening to involve all trade between the two countries. As the journal China Briefing, reports, “[As of Sept 2019] Total US tariffs applied exclusively to Chinese goods equals US$550 billion. Total Chinese tariffs applied exclusively to US goods equals US$185 billion.”

Most tariffs run at a stern 25%, although President Trump threatened an increase to 30% on Oct 1st 2019, which was then retracted (as of 13thSept 2019).

While it is not possible to connect reduced chemical industry production directly with the trade war, the ACC’s position on President Trump’s trade policies could not be clearer.

On August 23rd a press release stated that, “ACC and our members continue to believe that negotiation is more effective than intimidation and retaliation. [And] While we continue to support President Trump in his mission to hold China to account for its unfair practices, ACC and our members cannot support the means: harmful tariffs on our products and our customers’ products, ultimately paid for by consumers.”

Closing with, “U.S. chemicals manufacturers urge the United States and China to return to the negotiating table and rescind these destructive tariffs.”

Advice that the White House would do well to heed, as there is great logic in defending the American chemical industry, with the ACC’s 2019 edition of the Guide to the Business of Chemistry, outlining the importance of American chemical production to the economy as a whole.

The guide’s key findings include:

The American chemical industry is the second-largest producer in the world, providing nearly 14% of the world’s chemicals.

The American chemical industry provides 10% of all US exports.

The American chemical industry directly employs 542,000 people, and influences jobs for a further 4.4 million.

The American chemical industry invested $10 billion in R&D in 2018.

Such powerful figures should lead a powerful figure such as President Trump to look after the industry and to listen to chemical industry heads.

However, Donald Trump has often seen the trade war as a conflict focused on the trade deficit between China and the US.

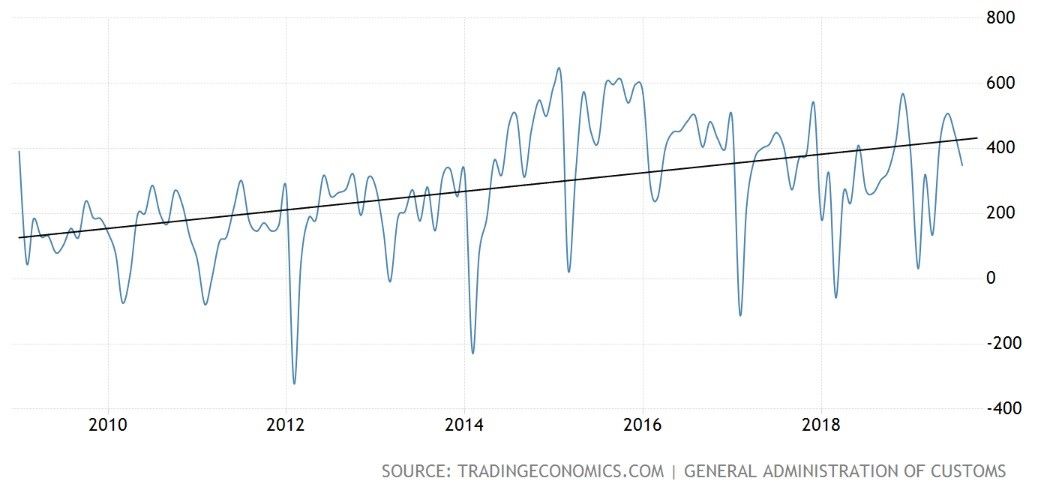

At present, the White House’s Office of the US Trade Representative acknowledges that, “U.S. goods and services trade with China totalled an estimated $737 billion in 2018. Exports were $179 billion; imports were $557.9 billion. The U.S. goods and services trade deficit with China was $378.6 billion in 2018.”

If current trade policy hopes to lessen the $378 billion deficit, perhaps policy should be focused on helping, or at least preserving the $31 billion trade surplus the US chemicals industry provided in 2018.

One piece of good news announced in Sept 2019, was the China’s removal of import tariffs for some products. As Time magazine reports, “Sixteen products including industrial lubricants, fish meal for animal feed and some other chemicals [including pesticides, cancer drugs, release agents, and Iso-alkane solvent] will be exempt from penalties of up to 25% imposed in response to President Donald Trump’s tariff hikes on Chinese imports, the [Chinese] Ministry of Finance said.”

However, it looks as if this decision is based on strategy rather than acting as an olive branch, as the report continued by noting that, “The move adds to suggestions both governments might be settling in for extended conflict by fine-tuning import controls and trying to find alternative export markets and suppliers.”

With Business Standard reporting that the trade war coupled with weak oil prices have caused industrial chemical prices to decline by 25% in the last 2 months. Perhaps chemical companies should start preparing for trench warfare.

At the time of publication (13th Sept 2019), trade talks between US and Chinese representatives are ongoing.

Photo credit: Tradingeconomics, Time, Businessinsider, & Newyorker