Rare earth elements are the ‘secret ingredients’ of the raw material supply chain. While every school child can see the importance of having access to steel, oil, concrete, and fertilizer, the significance of rare earths is rarely acknowledged.

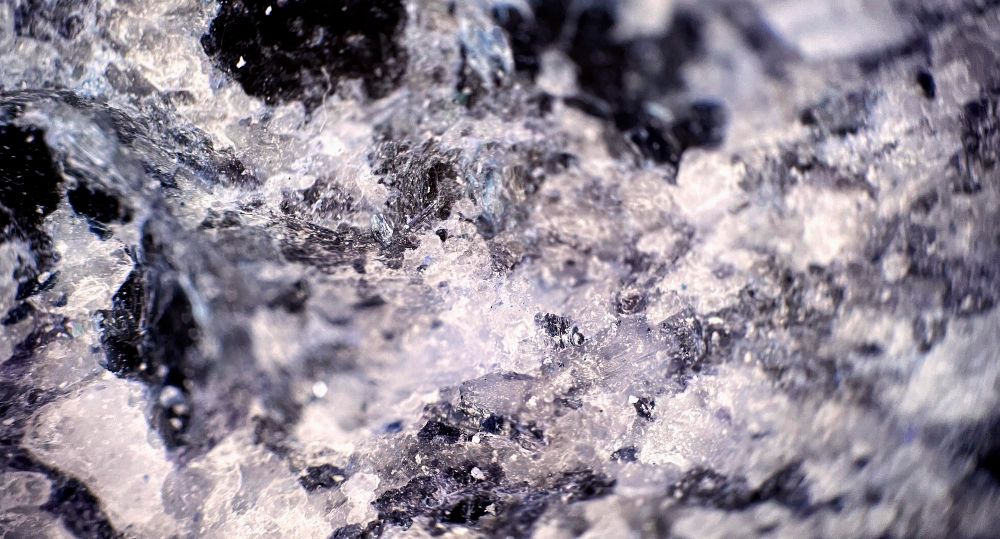

The rare earth elements (REE) are a set of seventeen metallic elements; the fifteen lanthanides on the periodic table (such as erbium, cerium, and lanthanum) plus scandium and yttrium. While only used in tiny amounts, they are essential raw materials for manufacturing high technology devices, such as smart phones, electronic displays, computer hard disks, and light-emitting-diodes (LEDs).

As the U.S. Geological Survey explains, “Although the amount of REE used in a product may not be a significant part of that product by weight, value, or volume, the REE can be necessary for the device to function. For example, magnets made of REE often represent only a small fraction of the total weight, but without them, the spindle motors and voice coils of desktops and laptops would not be possible.”

Rare earths are also needed to make guidance systems, satellites, radar and sonar systems, lasers, jet fighters, and other vital parts for the defence industry, making them significant on an even more urgent geopolitical scale.

Despite their importance, only a handful of countries are mining rare earths as they are found in only trace parts among huge quantities of the earth’s crust. This often makes them uneconomical to mine and process.

Thanks to vast investment from the Chinese government in the 1980’s, China holds the lion’s share of the rare earth element market, accounting for 70% of production (up from 58 per cent in 2021).

Due to their use in expanding manufacturing sectors such as modern communications, electronics, and defence, demand for rare earths is growing. According to Project Blue, a critical metals consultancy, “The global market for rare earths is set to amount to just $9bn in 2023, but is forecast to more than double in 10 years to $21b.”

Additionally, rare earth elements are used to manufacture permanent magnets, a vital component in the cutting-edge technologies for sustainable growth, such as wind turbines and electric cars. Without permanent magnets, wind turbines need more maintenance and electric cars will have larger heavier batteries. This makes rare earth elements essential raw materials in the shift away from fossil fuels and net zero.

This places the sourcing of rare earth elements a vital part of the EU’s ambitious environmental policy of sustainability, lower carbon emissions, and the Green Deal.

Even in fields of technology where Europe has established itself as a global leader, such as the manufacture of wind turbines, it continues to rely on essential parts coming from China. For EVs and other advances that are expected to fuel a greener future, the situation is similar.

Yet despite their role in Europe’s grand plans, the amount produced in Europe today, both in terms of mining and processing, is negligible.

“There are no significant demonstrated European reserves, [there is no] recycling technology available or being implemented, and there’s almost no processing technology downstream except for in China,” says Ton Bastein, a scientist at the Dutch research institute TNO. “They are a symbol of all the issues Europe has in critical raw materials.”

As part of the EU’s Critical Raw Materials Act (CRMA), which seeks to redress continental shortages of any product vital for strategic or economic health, officials in Brussels are taking steps to establish permanent magnet production facilities. For example, the EU has provided €19 million of funding to Neo Performance Materials to build a factory in Estonia.

However, given the complexity of processing rare earth element (which involves 1,500 steps), industry insiders claim that central government needs to do more if it wants to make the EU more self-sufficient.

They point to China’s long-term support for the industry which includes subsidies, price secrecy, and tightly controlled export quotas. Practices which help China dominate some markets with a 94% market share.

“The Chinese have perfected this industry for a very long time,” explains Sebastien Meric, the Rare Earth Business Line Director at Solvay. “They have fully automated their processes and are truly very strong.”

Chinese rare earth extraction and processing development is further aided by cheaper labour and lower environmental standards.

It is a situation that is coming to a head over plans to extract rare earths from the seabed of European waters.

While the European parliament has passed an initial vote (with 515 MEPs backing it against 34 opposed and 28 abstentions) to move forward with the plan, the idea is meeting considerable backlash from environmentalists. They are calling for a ban on deep-sea mining until research has been concluded on the impact it would cause to marine ecosystems and biodiversity.

Meanwhile, the International Energy Agency in Paris predicting demand for rare earths could go up by as much as 40 percent by 2040, leading extraction companies to push hard to speed the political process up.

“[The EU is] confronted with Chinese export restrictions on germanium and gallium,” says German liberal MEP Nicola Beer, who notes the EU’s dependency on China for 99% of its rare earth supply. She supports the move for deep-sea mining, adding that, “We're in geopolitically stormy waters [and] we cannot allow that to be the case.”

A last round of talks between EU member states and the European Parliament will now begin in an effort to reach an agreement on how to proceed.

However, there is a great deal of irony in the fact that the EU’s desire to be more environmentally friendly and move away from fossil fuels requires the rare earth elements which cannot be mined from the seabed due to fears over damaging the environment.

Whatever happens, Europe will need a stable source of rare earths over the coming decades if it is to remain economically competitive and defensively secure.

Hopefully, Brussels can iron out its differences and make some headway towards self-sufficiency, before rare earths become an even rarer product on the European raw material market.

Photo credit: Freepik, Vecmes, Freepik, Freepik, & Erich Westerndarp on Pixabay