The pandemic has taught the world many things; the importance of washing hands and staying healthy, how travel and being outdoors are linked to happiness, a lot of office work can be done from home, many low paid jobs are actually essential jobs. Everyone has learnt something about themselves over the past two years.

But for both investors and businessmen, perhaps the biggest lesson of all is learning the importance of raw material supplies.

Because of pandemic lockdown restrictions, consumers are noticing that shop shelves aren’t always full, some items have long wait times, and those products that are in stock, often have higher prices.

For example, in August, the NY Times reported on ‘pandemic-related product shortages’, while Bloomberg news reported that, “Tight inventories of materials as varied as semiconductors, steel, lumber and cotton are showing up in survey data, with manufacturers in Europe and the U.S. this week flagging record backlogs and higher input prices as they scramble to replenish stockpiles and keep up with accelerating consumer demand.”

It seems that only now is the public becoming aware of the intricate nature and crucial importance of supply chain functionality for even basic raw materials.

A lack of one raw material can have a devastating effect on specific industries.

Prices for natural gas, for instance, have soared since the summer and are now five times higher than at the start of the year. This led to some fertilizer producers from shutting down their facilities, as the energy costs made further production uneconomical.

The problem is that food grade carbon dioxide is produced as a waste product from fertilizer production. The CO2 is then bottled and sold for use in the baking of bread and pastries. It is also used in stunning pigs and poultry before they are slaughtered, and again as part of the packaging process for meat products. Carbon dioxide is also used in the refrigeration processes of countless food products, as well as putting the fizz in carbonated drinks such as lemonade and some beers.

The effect of natural gas price rises has resulted in some abattoirs and food producers having only a few weeks left of carbon dioxide reserves. Without additional supplies of this important raw material, supermarket shelves may soon run out of basic meat products. Consequently, governments are now stepping in to ensure that the food supply chain (especially in the run up to Christmas) is maintained.

The UK’s Business Secretary, Kwasi Kwarteng, has already met with major carbon dioxide producers to, “discuss the pressures the business is facing and explore possible ways forward to secure vital supplies, including to our food and energy industries”.

While Nick Allen, the chief executive of the British Meat Processors Association (BMPA), has attended emergency talks with British government officials, stating that, “This crisis highlights the fact that the British food supply chain is at the mercy of a small number of major fertiliser producers - four or five companies - spread across northern Europe. We rely on a by-product from their production process to keep Britain's food chain moving.”

In addition to the short-term shortages caused by the pandemic, there are still natural stresses of supply and demand caused by the planet’s ever-growing population, the increase in consumerism and wealth in Asia, Africa, and South America, as well as the simple fact that there is only so much raw material in the world.

It is a situation which makes for some harsh reading for manufacturers, but shows a real opportunity for investors.

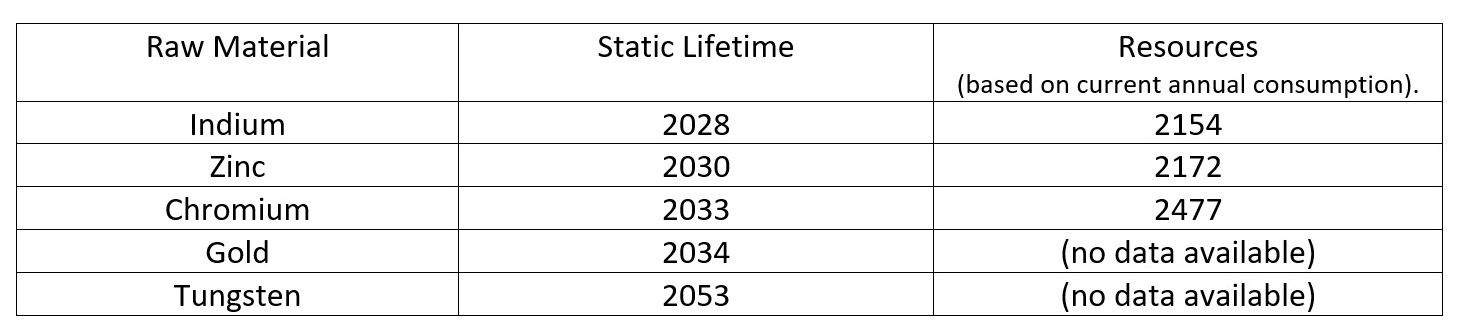

Analysis from the Clausthal Institute of Environmental Technology (CUTEC) estimated the ‘static lifetime’ of key raw materials. It is a figure that shows how long supply of specific ores and metals are reasonably expected to be available. It is calculated by dividing the reserves of a material by the current annual consumption.

Shockingly, the results (based on data from 2015) found that some materials are in drastically short supply. For example, the static lifetime of indium [used to make flat screen TVs] is 2028, only 13 years from when the study was conducted. Meanwhile, all economically viable reserves of copper, a metal that allows us to power almost all electrical equipment will disappear as a supplied product in 39 years’ time.

While technology and price changes may extend the static lifetimes of some substances, the full list published by the research team shows how significant a role raw material suppliers will play in the future.

Resources are the date when estimated raw materials will run out based on what is in the Earth’s core but cannot currently be mined with today’s technology. Static lifetime are the raw material reserves which can technically and economically be expected to be mined.

This data, alongside other factors, such as the price spikes of other key products such as natural gas, the shortages being experienced by manufacturers across the globe, is all drawing businessmen and investors to the importance of raw material supply.

In particular, the smart money is looking for raw material suppliers who have experience in working through previous shortages, have plenty of contacts and business partners to help maintain supply chain integrity, and companies with plans for future growth and expansion.

AG CHEMI GROUP is a well-established business that meets all these criteria.

Founded in 1994, the company (which funds this web page) has been supplying industrial chemicals and feedstock to a wide range of industries.

Business partners include, Sabic, Total, Volkswagen, EcoLab, Halliburton, PhosAgro, and many others. All of whom have appreciated the supply of industrial ingredients such as potassium sulfate, sodium nitrate, sodium hydroxide, and potassium carbonate.

While much of this work goes unnoticed for most consumers, it is only thanks to the consistent and timely supply of these materials that manufacturers are able to produce the fertilizers, cement, animal feed, plastics, rubbers, and other basic materials that modern life depends on.

Furthermore, the company is now expanding into nanotechnology to further aid its manufacturing partners with the use of nanomaterials to improve products and/or lower costs.

This expansion includes the construction of a NANO RESEARCH CENTRE and a 1,000-tonne nanomaterial production line. Funding for this has already been partially funded by governmental grants and individual private financers, but the remaining investment sum will be raised through the sale of corporate bonds.

Given the tense state in the market for raw materials and the growing success in the development and supply of nanomaterials, investors are taking a very close look at investing in this sector.

If you wish to be a part of this latest wave of investing, then you may want to consider purchasing corporate bonds in AG CHEMI GROUP. Offering a return of 6.8% p.a. which is paid monthly, the bonds can be bought for as little as 10,000 Czk and are available until June 2022.

To learn more about the company, visit: AG CHEMI GROUP.

To learn more about how corporate bonds work, read: How Corporate Bonds Provide a Healthy Return from a Safer Investment

To learn more about nanotechnology and its impact on manufacturing read: A Brief History of Nanotechnology and What it Means for Manufacturing

Photo credit: Erik Mclean from Pexels, Tom Fisk, jbarsky0 from Pixabay, NANO CHEMI GROUP, & Pexels, minka2507