For years, phosphate fertilizer prices were a generally static business. It has only been since the 2008 price spike that saw values soar by 800% that the future has seemed less certain.

Analysis of rock phosphate prices over the past 5 years shows considerable fluctuation in prices, indicating a continued lack of market confidence. But what else can we learn from the past and how it will impact phosphate fertilizer prices in 2019?

What can the phosphate fertilizer market of 2018 tell us about 2019 and beyond?

Phosphate fertilizer has always been in high demand (an agrichemical product that feeds the world will never be short of customers), but 2018 saw significant events that will shape this year’s supply. Mergers, rising costs, environmental concerns, big development plans, and global sell offs will all impact the fertilizer raw material market in the coming months, most of these events pushed prices skywards.

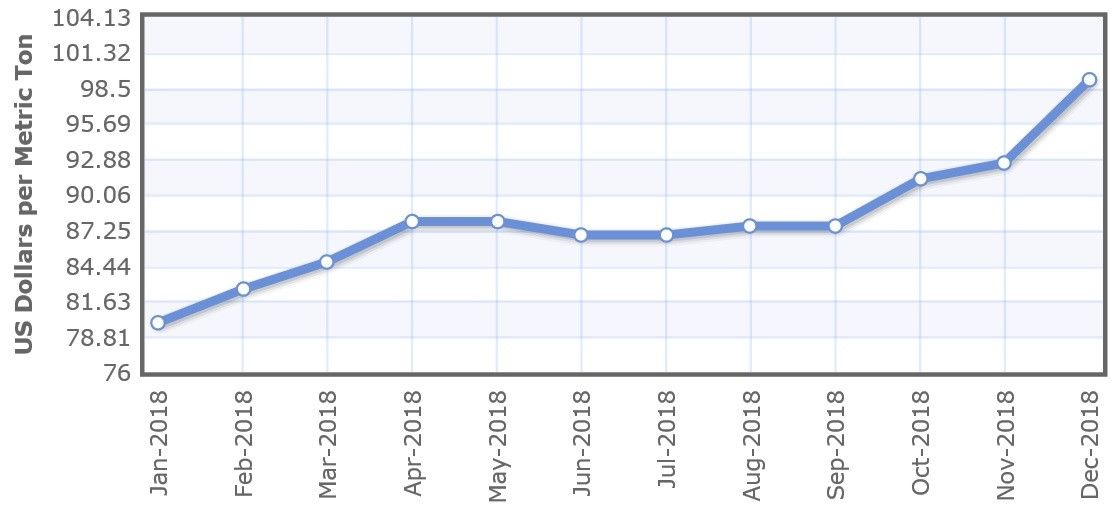

As Investing News states, “In December 2017, the price for 1 metric tonne of phosphate was US$80.22, while in November 2018 that price had grown to US$92.50. Prices were flat from December 2017 to February 2018, but from there rose incrementally every month with only a brief period of decrease mid-year.”

This upward price trend looks set to continue as outlays increase, with agricultural input specialists at the industry consultancy CRU, estimating that next year, “… on average, costs will rise by around 1-3% for both phosphate and nitrogen producers.”

Agricultural Raw Materials and the Environment

Environmental concerns are increasingly affecting the agricultural input supply chain as governments apply pressure on the industry to lower farming impact.

Public and media pressure is also causing the industry to react, with a series of programs and developments being initiated to maintain clean waterways, encourage soil health, and prevent algal blooming.

For example, the international fertilizer supplier Yara recently announced a cooperative agreement with Veolia to “to develop the circular economy in the European food and agricultural chain by recycling nutrients and creating nutrient loops.”

This is just one of a number of significant steps being taken by the industry. As Svein Tore Holsether, President and CEO of Yara, states, “Reducing global resource depletion and nutrient loss by increasing the recycling of nutrients such as Nitrogen and Phosphorus is an important task.”

However, nowhere has felt more pressure to lessen environmental impact than China, where closer adherence to the President’s ‘Blue Skies’ policy and ‘Xi Thought’ is forcing the agrichemical industry into major changes, and the relevant costs incurred. As Alexander Derricott, Senior Analyst of Fertilizer Costs at CRU notes, “the [Chinese] central government’s introduction of tougher environmental policies has brought new challenges of supply disruption and higher production costs. With 29% of the world’s DAP capacity and 36% of the world’s urea capacity, adaption to this new business environment will prove critical to global price developments across most fertilizer markets.”

Unlike action in Europe and America, where solutions are sought jointly by government and industry (often in the form of research grants into new farming techniques, improved agrichemical products, high-tech application of farm chemicals or slowly introduced chemical restrictions), China’s fertilizer industry must react much quicker.

With the impetus for environmental protection being led by the Chinese politburo, the impact on fertilizer producers is largely based on tax increases, factory operating restrictions and shutdowns. However, implication of policy is piecemeal and regional, as Derricot observes, “The new taxes target solid waste, gaseous emissions, water pollution and noise pollution. Regional governments have retained the power to set the new tax rates, meaning different cost implications across the provinces.”

AgriChem Industry Mergers

By far the biggest merger in the phosphate fertilizer industry of 2018 was the formation of Nutrien, made up of Canada’s Agrium and the Potash Corporation of Saskatchewan. The new company was formed due to falling potash prices from over-supply in 2017, as well as synergies that created a stronger new entity with a market value of US$36 billion (the world’s second largest phosphate fertilizer producer).

As Canada’s CBC reportedat the time of the merger, “A glut of potash on the world market has caused prices to plunge and led to layoffs and mine closures across the industry.”

Since the merger, the new company has performed well, as phosphate prices rose through much of 2018. As Nutrien’s Q3profit update explains, “Global phosphate prices were supported by strong demand and higher input costs for ammonia and sulfur.”

Fertilizer Feedstock Development Plans

Another Canadian phosphate company with big plans for 2019 is Arianne Phosphate which recently announced the development of a maritime terminal facility to handle the export of fertilizer feedstock from its Quebec mines. As the company stated in its press release from October 2018, the project will, “allow for efficient and cost-effective transportation of Arianne’s high-purity, premium-priced phosphate concentrate globally and, will open new markets for the Company.” Adding that the company predicts it will aid its Lac à Paul project which it expects will, “… produce 3 million tons a year of phosphate concentrate for 26 years, making it the largest independent phosphate mine set to come on stream.”

Elsewhere, significant expansion of phosphate production continues in Australia, where Verdant Minerals has moved ahead with its Ammaroo phosphate project. While still in its developmental stages it is hoped that the mine will produce a billion tonnes of phosphate over the coming years. In October 2018, the project received governmental permission from the Northern Territory Environmental Protection Authority to proceed.

But Canada and Australia are not the only places for fertilizer raw material production growth. As Investing News reports, “… other countries are ready and willing to ramp up phosphate production, particularly in the Middle East and North Africa, where it is cheaper to produce phosphate.”

Further investment and expansion should also be expected over the coming months, as other fertilizer feedstock producers believe that the time for expansion is now. As a recent report for CRU, by Chris Lawson, Head of Phosphates, makes clear, “[W]ith sentiment improving, and demand remaining strong, … investment opportunities are now being considered more seriously.”

China has the Fertilizer Market to Watch

Ultimately, with such an enormous market and so many geo-political, environmental, and supply/demand factors predicting future fertilizer feedstock prices will never be easy. However, some factors, such as China, stand clear as market influencers.

As Lawson, notes, “Developments in China will be key to how the industry evolves over the medium term. While new capacity will continue to be built elsewhere, potential closures and issues in China could present opportunities in this ever-changing market.”

Adding that, “Producers will need to be wary of any drastic price increases, with favourable fertilizer affordability levels a major factor behind recent demand growth. Nevertheless, sentiment is seemingly turning more positive in the downstream phosphate market.”

Perhaps, despite all of 2018’s price increases, 2019 will be as successful after all.

Photo credit: IndexMundi, Plantcare, Verdant Minerals, Agrienvarchive, Ejinsight, & Lapresse. Pexels