In June 2019, the US bio-chemicals firm Genomatica announced that it was expanding its renewable chemical product line by acquiring assets from the Renewable Energy Group.

As the company reported at the time, “The acquisition provides us with our third major product platform, allowing us to expand into household and industrial cleaning products, and flavours and fragrances, further growing our ingredients for the apparel, packaging and personal care markets.”

Yet while Genomatica may be optimistic about the future for renewable chemicals, is their purchase well-founded on fact or does their expansion go against the flow of multi-billion-dollar investment in petrochemical facilities.

What is the state of the renewable chemicals market in 2019?

While first thoughts on the topic of renewable chemicals may be to instantly imagine double-digit growth fuelled by both consumer and governmental demand for ‘greener’ raw materials and for inclusion into the circular economy, this is not a guaranteed outcome.

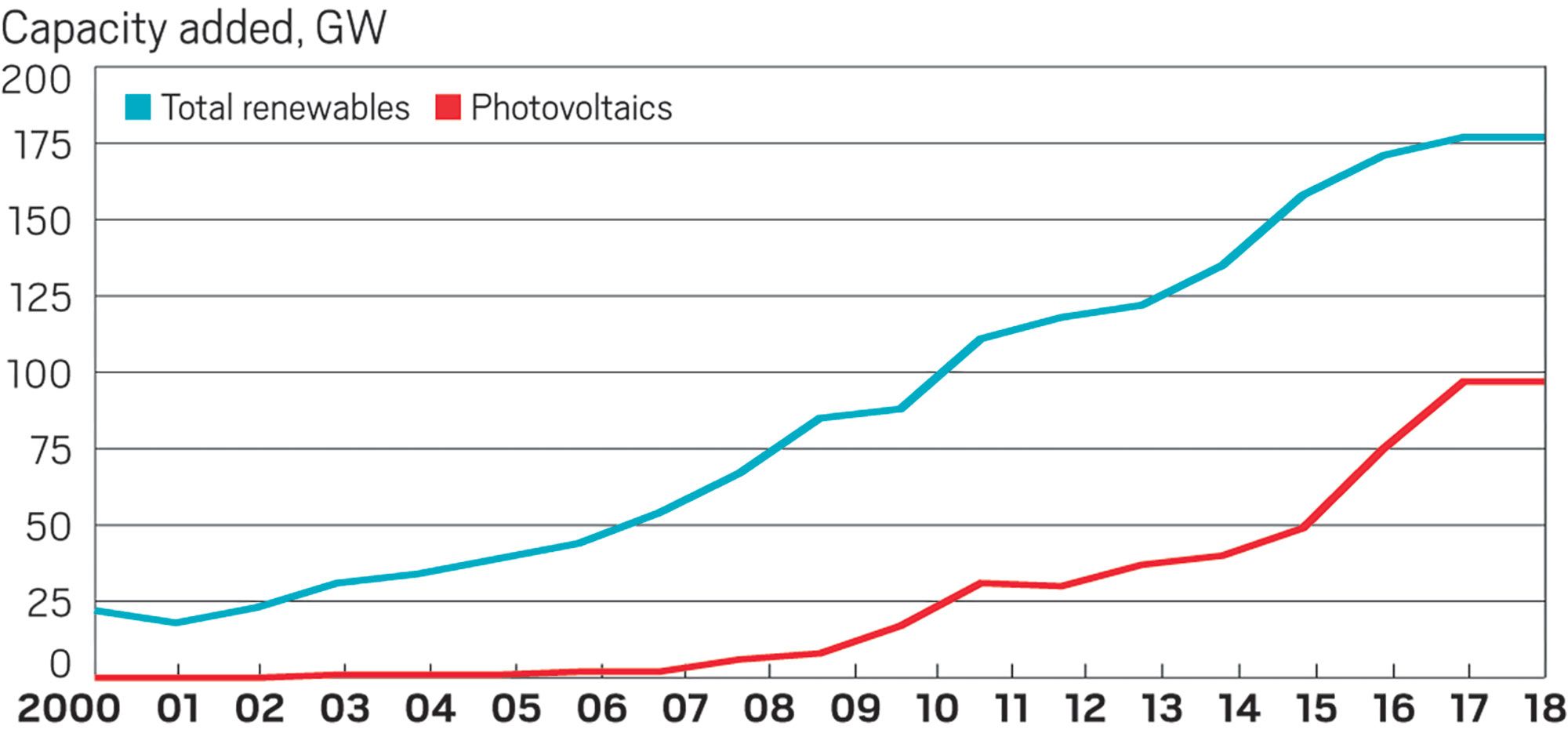

One need only look as far as the renewable energy market, which is experiencing a period of uncertainty, to see that sustainability is not a free pass to success. As the industry journal Chemical & Engineering News reported in May 2019, “Last year, for the first time since 2001, the world did not increase its rate of growth for new capacity to produce renewable energy, according to an analysis from the International Energy Agency. That’s a problem because meeting the goals of the Paris Agreement to curb greenhouse gas emissions will require 300 gigawatts (GW) of new capacity every year until 2030. In both 2017 and 2018, new capacity grew by only 177 GW.”

But while the renewable energy industry may have hit a glitch, investment into renewable chemical capacity is worse, with Lux Research Inc. finding that, “Venture capitalists have invested $5.8 billion in start-ups in bio-based materials and renewable chemicals since 2010.”

Less than $6 billion invested in 9 years in an industry worth $5 trillion is a poor indication of the value of the renewable chemical market.

However, the researchers also found that beyond low rates of investment, the renewable chemicals industry was also facing a new trend, as investors are increasingly aiming towards “disruptive synthetic biology and conversion technologies” as opposed to simply replacing fossil fuel-based chemical products.

Chemical industry analysts, such as Marifaith Hackett, director of renewable energy and nutrition at IHS Markit, believe this shift is part of a maturing of the renewable chemical market, as customers seek more than a straight ‘like-for-like’ eco-friendly chemical product. Instead, those sourcing chemical raw materials hope to gain other advantages, such as cost savings or improved product performance, alongside the chemical product’s greener credentials.

Specifically, market research cites the fact that Coca-Cola, Danone, Nestle, and Sandley are turning to bio-polyethylene terephthalate (bio-PET), as an example of successful development of renewable chemicals.

However, these companies made the switch for numerous reasons, as Arnold Bos, a consultant at Lux Research, notes, “We have seen increasing demand for renewable chemicals from end-users of polymers such as IKEA, Nike and Coca-Cola. They are not only doing this to improve their image, they are also preparing for the future, and they want to hedge rising oil prices and increase product choices based on renewable energy.”

A further example of how chemical suppliers are seeking more than the simple virtue of sustainability is being made by the Amsterdam-based chemical company Avantium, who believe that chemical purchasers are scrutinizing performance much more than ecology.

As the company explains, they are, “… using catalytic technology to convert sugar contained in plants into 2,5-furan-dicarboxylic acid and polyvinyl furan-dicarboxylic acid (PEF). PEF is a 100% recyclable plastic with better properties than petroleum-based packaging materials, such as PET. Compared with PET, PEF has stronger performance, better heat resistance, and better gas barrier performance.” The fact that its plant-based chemical raw materials “can be biodegraded in a few years, while the degradation of PET takes hundreds of years” is of less importance to its value as an industrial chemical than its other physical properties.

It is these performance properties that lead the company to predict that its market potential is “estimated to exceed €200 billion per year”, of this total €150 will be used in packaging, and €40 billion in textile manufacturing.

Avantium’s success or failure will not be based on a green trend, or even a boardroom desire to meet Paris Agreement targets, but on the hard facts of product comparison. The result is that chemical producers will continue to lean on petroleum-based raw materials due to simple chemistry and will do so as long as oil prices remain relatively calm.

As the renewable chemicals analysts at the Green Chemicals Blog stated as the start of the year, “the key takeaway for 2018 is that the renewable chemicals industry definitely continues to struggle.” And while “pockets of investments for renewable chemical building blocks” do exist, the industry as a whole lacks investment at the key stage of turning laboratory discovery into industrial scale production.

For the renewable chemical market to truly take off, it needs to focus on performing in ways that beat fossil fuel feedstocks. Be it through 100% resource efficiency, label-free chemistries which require no chemical warning symbols, or performance-boosting nanoparticles; greener chemicals must be more than just green.

By striking at these issues and others, the renewable chemicals industry will avoid becoming a green trend and will instead be the future of chemical raw material sourcing. For while much has been written about sustainability in the chemical industry, businesses will always weigh their decisions almost solely on cost and performance.

Photo credit: CEN, Iowaeconomicdevelopment, Lifesizemedia, Openpr, & Ptonline