Chemical business owners are always trying to predict what will happen next. Asking where is the next growing market, what will consumers be looking for three years from now, and considering geopolitical situations, how secure is my raw material supply chain?

However, one predicting tool that is all too often overlooked is demographics – a science which can analyse the past, see its effects on today, and apply the same tools to foresee the future.

In this way it is important to look at the one area which has driven prices, output increases, and market demand for plastics the most over the last three decades – China.

As John Richardson, an ICIS polymer markets analyst writes, “China had a 22% share of the global population in 1992 and a 9% share of global polymers demand (of the nine basic feedstocks). By the end of this year, ICIS forecasts that China’s share of the global population will have slipped to 18%, but its share of global polymers demand will have risen to 40%.”

Despite a falling population, China’s growing demand for polymers is driven by housing construction. Building homes requires plastics for windows, water and waste pipes, insulating materials, adhesives and even more interior products, such as washing machines, furniture, carpets, paints, TVs and other items that homeowners desire.

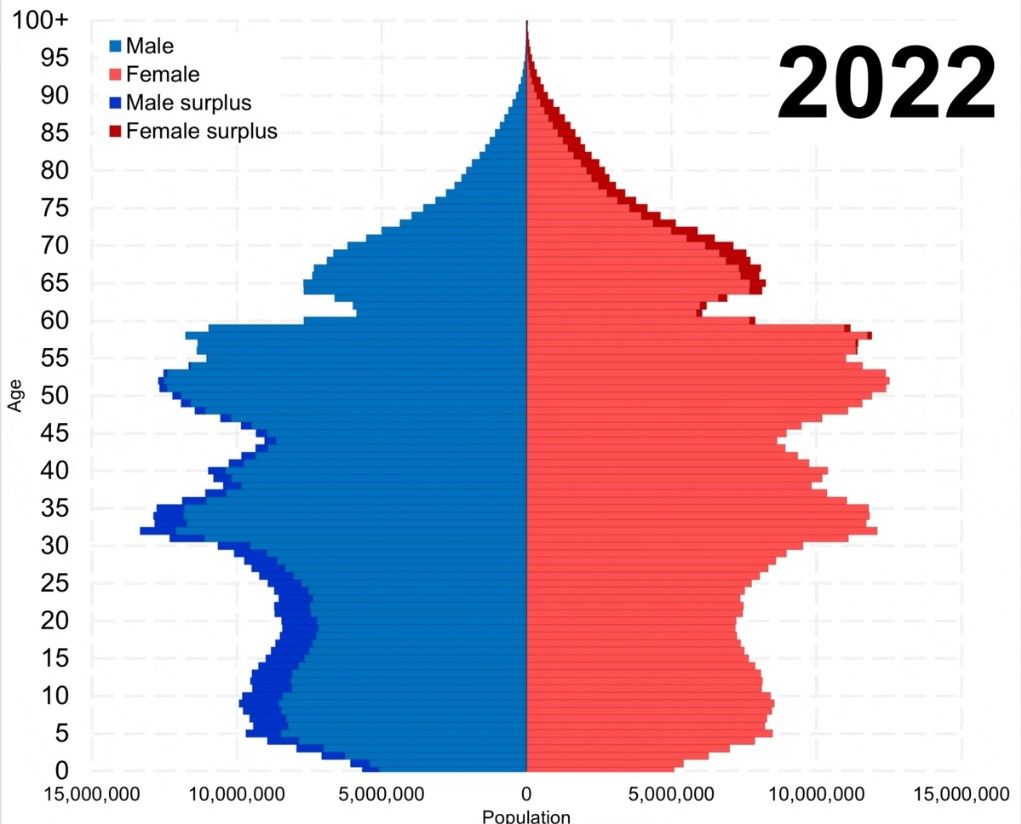

Yet, the demographics of the Chinese population shows that fewer houses will be needed over the coming years, as the population ages and experiences a much smaller group of people at the age of settling down and having children.

As the data shows, this is having a major effect on house building.

“About 693 million square meters of new homes started construction last year, down 21 percent on the previous year and nearly 60 percent from a 2019 peak, according to data from China’s National Bureau of Statistics. The figure dropped 40 percent year on year in 2022,” wrote the Yicai Global earlier this year. Adding that, “The construction of new homes in China [in 2023) fell to the lowest level last year since 2007, mainly because of weak property market demand.”

It is a point highlighted by ICIS polymer market consultant Paul Hodges when he wrote that, “China’s housing bubble was the biggest the world has ever seen. At its peak, housing represented 29% of GDP. And it was mostly financed by borrowed money because China’s disposable incomes are very low. Even in richer urban areas, these averaged just $7,322/capita (Rmb 52k) in 2023. So, it is no surprise that the boom is now being followed by a bust.”

At the same time, China has invested heavily in polymer production, building a number of mega-sized facilities at breakneck speed to dominate the market and use economies of scale to force closures in Europe and Japan.

Add these predictions to the increasing pressure on polymer manufacturers to reduce emissions and enter the circular economy and the future looks quite bleak.

This leads John Richardson to ask, “How much of the polymers demand growth that we saw in China from 2009 onwards was the result of a one-off construction boom?”

And if the housing boom collapses, as the demographics forecast, then it is likely that polymer demand will fall with it?

To learn more about these forces, read: Germany’s Chemical Industry Woes Continue or Europe’s Petrochemical Future Questioned by LyondellBasell Review or even The Troubles Caused by China’s Aromatics Boom

Some polymer industry insiders believe that technology may save the industry.

For example, improved recycling approaches (plastic digesting microbes perhaps) would be beneficial to both the market and to the environment.

Artificial Intelligence is seen as another route to cost reduction, with Joe Chang, an ICIS polymer market expert, noting an Accenture report, stating that, “Production employees, who make up almost half of the [chemicals] workforce, spend 90% of their time on transactional matters and tasks involving simple judgment and only 10% of their time on complex judgmental tasks.” From this the report deduces that, “Chemical companies can restructure work to allow gen AI to take on routine tasks, freeing up workers to focus on more creative and meaningful tasks.”

Nanotechnology could also assist, as the development of nanoscale modification of polymers is enabling plastic products with improved properties, such as added strength, UV protection, crack and scratch resistance, or electro-conductivity.

To learn more about the nanoscale modification of polymers you might like to read: Nanoscale Modification Gives Polystyrene an Antimicrobial Surface

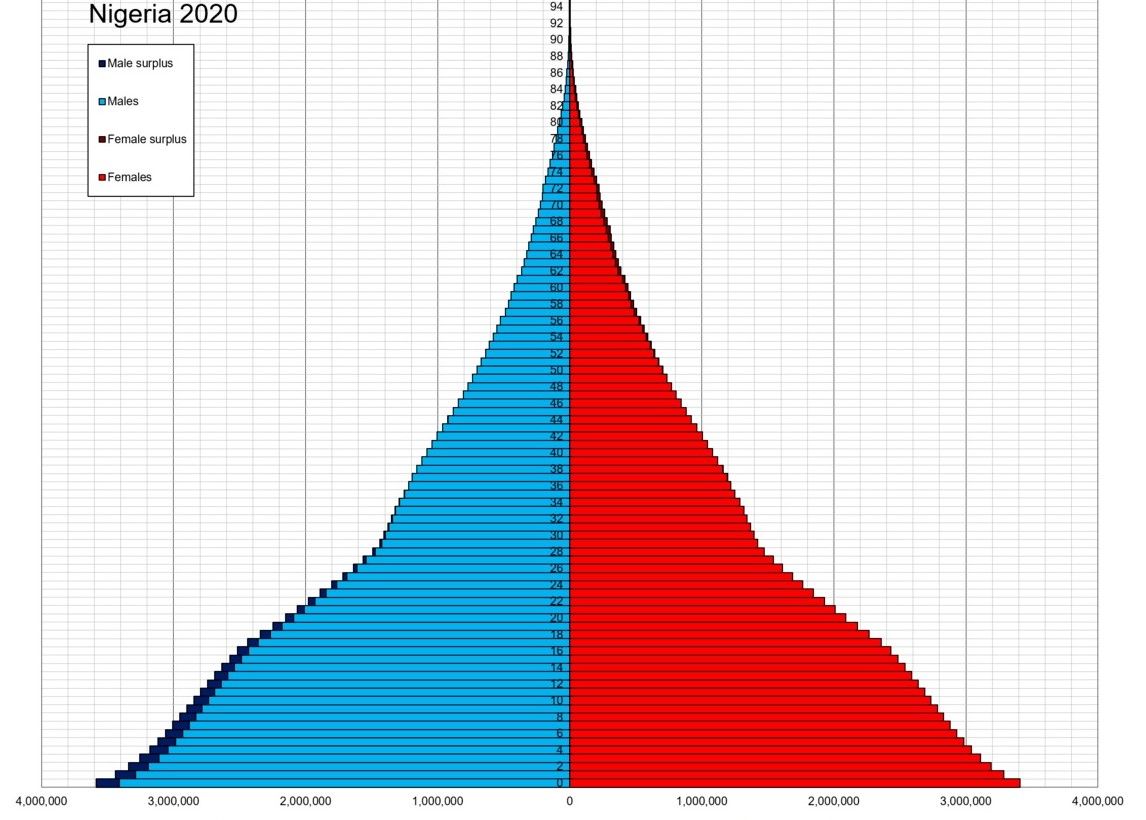

Demographics may also save the polymer industry with a growth in middle classes in a number of developing countries. Mexico, Nigeria, Brazil, and India are relatively poor, but as their young populations grow richer, they will demand the luxuries and housing opportunities (with associated polymer products) which are currently the preserve of the west (Europe, North America, and Australia).

When combined, these seismic demographic transformations will have profound implications on polymer markets. Countless factories and businesses connected to the polymer supply chain will be forced to adjust with those in China likely to suffer the most.

If the data is to be believed then the country's demographic winter is poised to wreak havoc on its real estate market and, in turn, devastate the entire polymer industry, with ripple effects that could be felt across the global economy. China's looming demographic cliff poses an existential threat not only to its housing sector, but to the very foundations of its economic might.

Polymer suppliers and producers have now been warned. Not because it was written in the stars, but because it was written in the demographics.

Photo credit: Wikimedia, Flickr, Wikimedia, Ilya on Pexels, & Rawpixel