An unhealthy population has created unhealthy economic conditions, and the diagnosis for the chemical industry is poor.

During a recent check-up, the American Chemical Council (ACC) found that U.S. chemical production for April fell by 5.1%.

Further reading is equally depressing. The report stating that, “…industrial production tumbled 11.2% in April, following a 4.5% decline in March…Mining output contracted for a third month…Manufacturing output fell for a fifth straight month, by 13.8%...Many sectors posted double digit declines…Motor vehicle output was off 71.7% (following a 30.0% decline in March)…Other large contractions were in aerospace, primary metals, furniture, petroleum textiles, and printing…For a second month, every single major manufacturing sector declined…Compared to a year ago, industrial production fell 15.0%.”

Specifically for the chemical industry, “… chemical railcar loadings, the best ‘real time’ indicator of chemical industry activity, fell by 977 to 28,762 railcars during the week ending 9 May…Chemical prices fell 2.1% in April…Pronounced monthly declines were experienced in feedstock prices as well as prices for bulk petrochemicals and organics, plastic resins and synthetic rubber…Compared to a year earlier, chemical prices were off 5.0% with feedstock prices off 45.5% Y/Y…Chemical import prices fell in April by 2.3% and were off 6.0% Y/Y…Export prices declined 2.7% and were down 6.2% Y/Y.”

Beyond poor physical health, examination results like these can easily cause other ailments, such as depression.

But the data is of course, merely a snapshot and does not reflect the total health of neither the chemical industry nor the economy as a whole.

More like a patient who has had a heart attack, the immediate onset is life threatening and possibly fatal, but with proper medical attention, an improved diet, and more exercise, the patient can be in much better shape than before the attack occurred.

So, it is with the global economy and the chemical industry, where the long-term outlook is surprisingly buoyant.

As Kevin Swift, the ACC’s chief economist explains, “While there is significant uncertainty in the projections, short-term risks are to the downside before a possible rebound in 2021.”

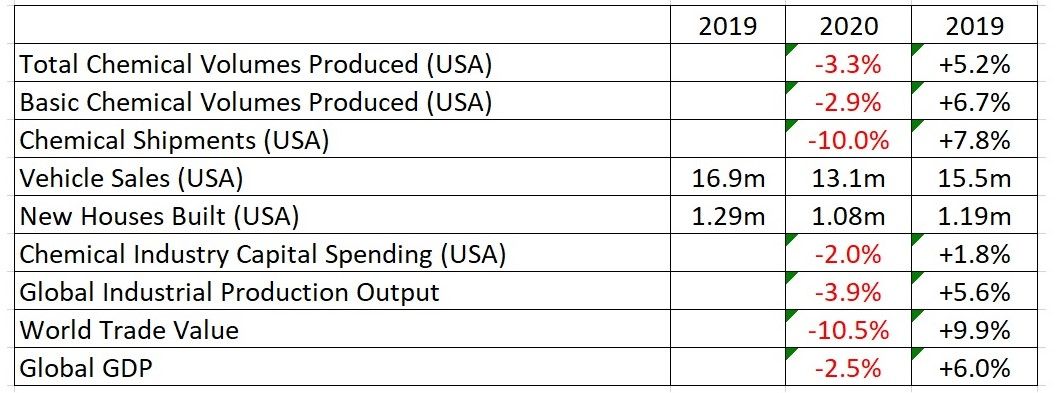

Analysis of the data for next year is actually far more promising, and while further waves of coronavirus must still be accounted for, the prognosis for next year is far more upbeat, as the industry journal Chemical Engineer reports in the data below.

At the start of 2020, there had already been predictions that the economic bubble would burst, spurred on by stock market volatility and the perpetuation of the US/Chinese trade war. Such fears made the economic conditions for 2020 less stable than previous years.

As Martha Moore, senior director of policy analysis and economics at ACC, notes, “Industrial activity started the year on a weak note even before news of COVID-19 emerged in late January. Then supply disruptions from China began to percolate through the U.S. industrial sector. With further shocks to aggregate demand, U.S. industrial production is set to fall 8.4 percent this year before growing by 2.6 percent in 2021.”

The ACC is therefore predicting a quick return to pre-pandemic economic conditions, with global GDP contracting by 2.5% in 2020 and then rebounding 6% in 2021.

However, look even further into the future, and forecasts paint a very healthy picture for the American economy, with a recent study of global demographics showing that the US is well placed to continue to lead the world in terms of economics.

Despite the last two decades showing a huge surge of growth in the Chinese economy, the US still accounts for 35% of world GDP from just 5% of the population.

China, with more than 20% of global population, still lags behind, and according to Ken Gronbach, the president of the demographics analysis firm KGC Direct, the Chinese economy will begin to lose ground on America in the coming decades.

In a recent online speech to the chemical industry body SOCMA (Society of Chemical Manufacturers & Affiliates), Gronbach explained how analysis of data on marketing and demographics shows that, “The U.S. economy will not suffer as a result of COVID-19 because of its position in the global landscape.” Instead, “Coupled with population data and marketing trends, the assessment sees the diverse yet balanced workforce in the U.S. as its primary asset. Comprised of the millennial generation, immigrants and both educated and skilled workers, the U.S. demographic dividend will propel the repatriation of manufacturing from China.”

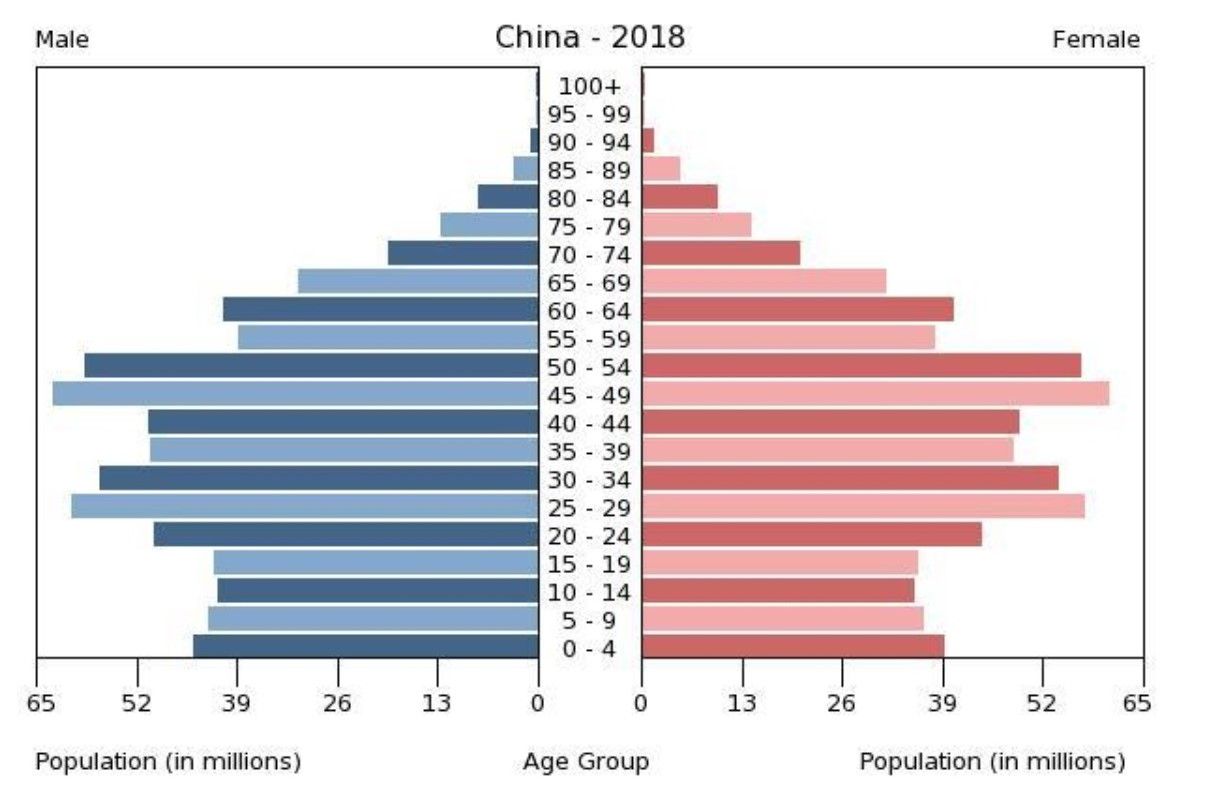

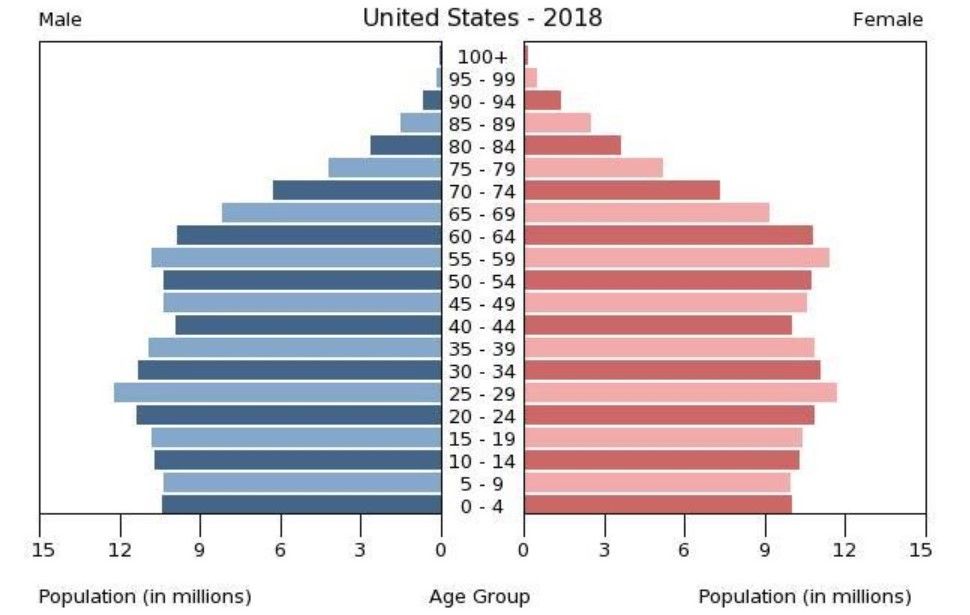

As a demographic comparison of the population age charts from the CIA WorldFactbook shows, over the next two decades, China will have an ageing population supported by a smaller group of wage earners.

Meanwhile, in America, 88 million millennials will be hoping to leave home, creating a housing shortage of 25 million homes, while also spurring a boost in economic health from a more active workforce.

As SOCMA concludes, “China’s demographic dividend, a large and cheap labor force, is aging and will end China as a manufacturing powerhouse. As a result, U.S. manufacturing, powered by a strong millennial population, will rise.”

Good news indeed for the chemical industry in America and a healthy return to normal for chemical companies.

Photo credit: CIA WorldFactbook, Josh Hild from Pexels, Aaron Schwartz from Pexels, mohamed Hassan from Pixabay, & Pexels from Pixabay