For many years now, concerns over a global shortage of rare yet essential raw materials have been growing. But are these fears real?

Throughout history, there have been periods when essential raw materials have been in short or dwindling supply, yet economies have always survived.

During the 1970’s, there was widespread panic over oil supply shortages due political instability in the Middle East. While petrol pumps did run dry, new oil fields were soon developed in other regions to take advantage of the price spike.

In the late 1800’s, dwindling supplies of guano (bird droppings) for making fertilizer took countries to war, yet technology (the Haber-Bosch process) and substitutes (rock phosphate) were soon found and exploited.

Today, unease over a shortage of rock phosphate still persists, despite geologists confirming that more 300 years-worth of deposits still remain.

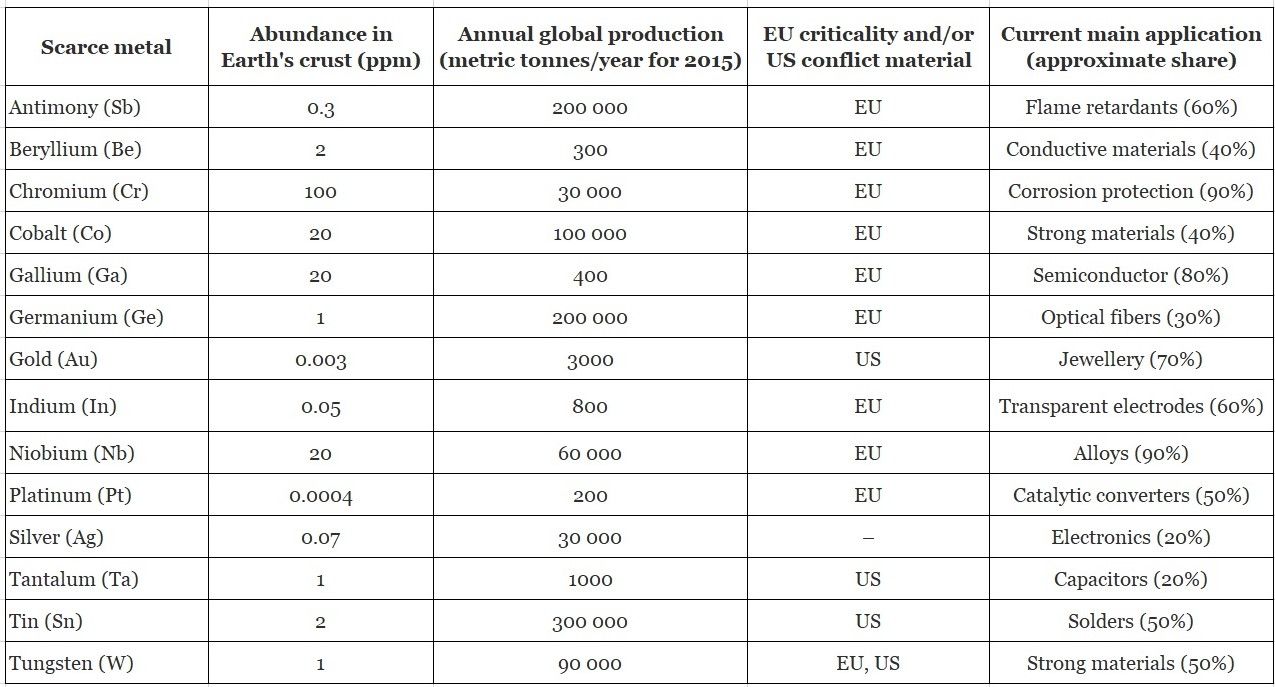

Fears over rare raw material shortages today are largely based on the ever-increasing demand for the products they make. As technology has advanced, so has demand for rare minerals, rare metals, and rare earth elements (REE) that are used in modern composites, high-spec manufacturing processes, electronics, and advanced defence systems.

As a report published in the scientific Journal of Cleaner Production, states, “The increasing use of geochemically scarce metals in society is problematic. For example, while a circuit board in the 1980's typically used 11 elements, this increased to 15 in the 1990's and to 60 in the 2000's. Along the same lines there has been an increased use of scarce metals in vehicles. [While] a transition to electric vehicles may further raise the use of scare metals, such as lithium, cobalt, nickel, manganese, silver, and copper.”

In response, extraction of many raw materials has grown, as the study notes “The global mine production of ten metals has increased considerably between 1990 and 2000 [namely]: aluminium, chromium, nickel, tungsten, copper, zinc, iron, gold, lead, silver, and tin.”

However, the growing variety of raw materials needed for modern production needs, combined with the uneven distribution of materials in the Earth's crust means that for many substances, it is simply not possible to boost extraction to all markets.

Additionally, scarcity of raw materials is not limited to rare metals. As the American Chemical Society notes, “Of the 118 elements that make up everything - from the compounds in a chemist’s arsenal to consumer products on the shelf - 44 will face supply limitations in the coming years. These critical elements include rare earth elements, precious metals, and even some that are essential to life, like phosphorus.”

To ensure the continued modernisation of industry, and to maintain vital industries such as communication and defence, governments have focused their efforts on securing supplies of rare raw materials.

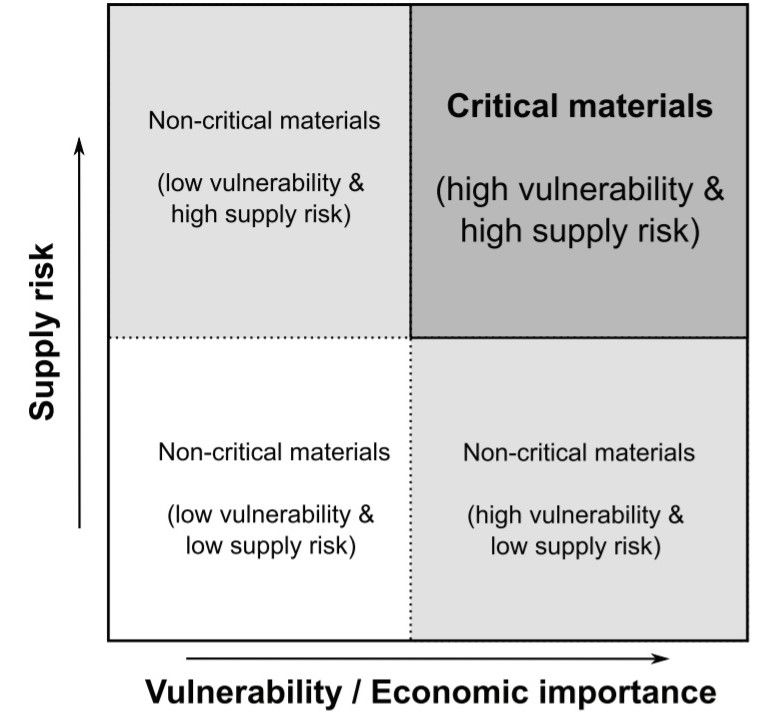

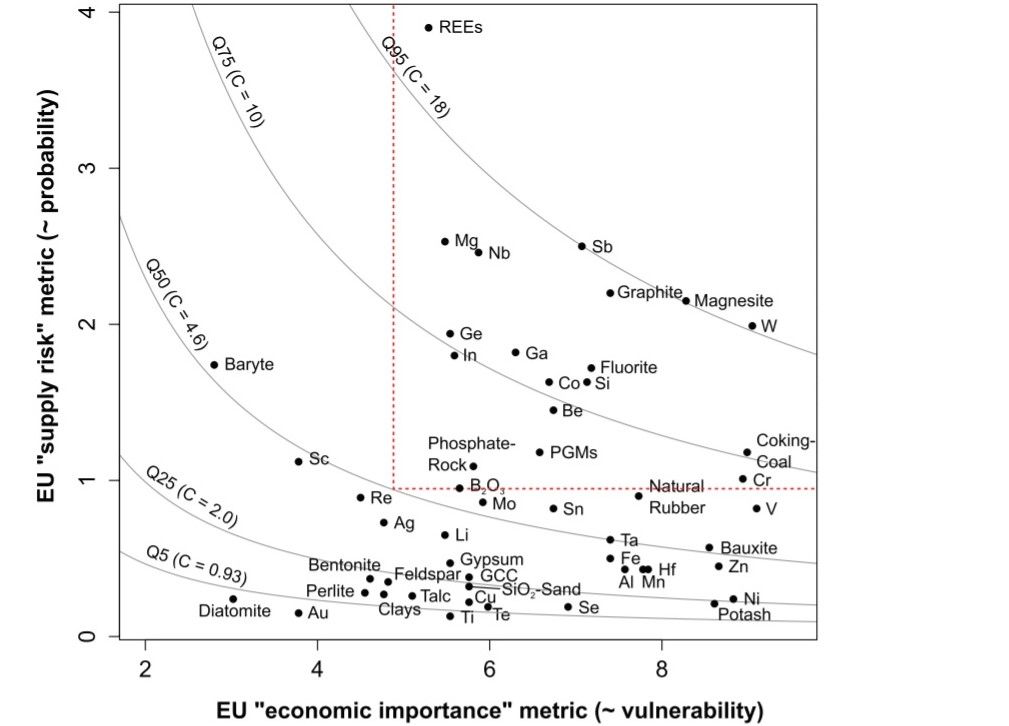

For example, in 2014, the European Commission developed a list of critical raw materials, defined as substances which have a combination of high supply risk and high economic importance. Other institutions have also assessed other factors, such as environmental impact, substitutability, and their role in funding conflicts, such as the sourcing of tin, tungsten, tantalum, and gold (3TG) in the Democratic Republic of the Congo’s recent civil war which claimed an estimated 6 million lives.

However, some economists question the importance or the method in which a raw material is labelled as ‘critical’.

As the study ‘Raw material ‘criticality’—sense or nonsense?’, published in Journal of Applied Physics, states, “Current assessments of raw material criticality are flawed in several fundamental ways. This is mostly due to a lack of adherence to risk theory. These flaws do not mean that the general issue of supply security of raw materials can be ignored, but rather, that new assessments are urgently needed.”

Interestingly, the study concludes that new and improved assessments of raw materials achieving ‘critical’ status, “… will likely include more of the traditional industrial metals, particularly those related to steelmaking (Fe ore, coking coal, Cr, Ni), and power infrastructure (Cu).” Adding that, “The greatest challenge in the resource sector for the longer term is to counteract the escalation of unit energy costs of production.”

This study’s prediction that there exists a risk of raw material shortages has been supported by a study from Yale which also concluded that material scarcity is a very real problem, particularly as the developing world is expected to ‘catch up’ with more advanced societies. The study even calculated that it was impossible for future supply for some materials to match future demand – at any price. The research stating that, “Providing today's developed-country level of services for copper worldwide (as well as for zinc and, perhaps, platinum) would appear to require conversion of essentially all of the ore in the lithosphere (Earth’s crust) plus near-complete recycling of the metals from this point forward.”

While predicting the future has always been a game best left to bookmakers and tarot card readers, it is clear that raw material markets will need to adapt quickly if current trends continue.

Options to prevent shortages include increased recycling of rare earth elements and rare minerals, more efficient processing methods, or a shift in production priorities, as many rare elements are currently produced as a by-product of other refining processes. If all these avenues are followed, then maybe, just maybe, we can avoid a global shortage of rare raw materials.

Or are there substitutes waiting to be discovered?

Photo credit: ACS, Iopscience, Miningglobal, Theassay, Newsbulk, & Mining