There are many places to keep your money: in stocks and shares, in government bonds, in company bonds, in gold, in the bank, or even under your mattress.

However, those with plans for investing in the medium to long-term are being increasingly drawn towards investing in nanotechnology.

As Brian M. Reiser, an investment analyst at Investmentu explains, “When one thinks of technology, one may think of things like televisions, I-phones, computers, and the internet. One may even be thinking about today’s most innovative technologies like blockchain and artificial intelligence. One may be less inclined to be thinking about matter working on an atomic level. But for those keeping an eye on nanotechnology stocks, atomic level matter is precisely what the tech stock investor has in mind.”

While investing in technology has always made sense for those placing their money somewhere for the long haul, nanotechnology often slips under the radar as most financial advisors know so little about it.

Nanoproducts are smaller than 100 nanometres, which is a thousand times smaller than the thickness of a single sheet of newspaper.

Simply put, materials at this scale function differently to how they work in the macroscale. This means that a substance such as silver which is magnetically very weak at a large scale can exhibit strong magnetic attraction at the nanoscale while still retaining many of its other benefits as a material.

This ability to modify ingredients so that they have additional properties is of great value to manufacturers.

For example, car tyres with added carbon nanotubes can be made 20% lighter (reducing fuel consumption), more durable (lasting twice as long), and electrically conductive (a crucial requirement in tyres).

Nanomaterials are already being used in thousands of everyday products, but as an industry that is only 30 years old, it still possesses great potential for the future. Sectors such as supercomputing, pharmaceuticals, next-generation batteries, as well as biotechnology are likely areas of growth for the young nanoindustry.

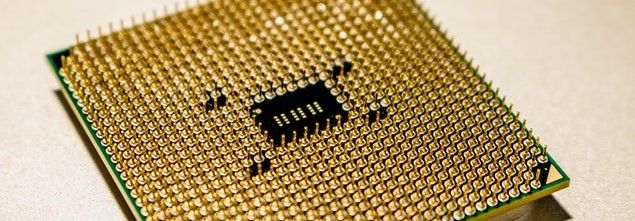

In the rapidly expanding electronics market, for instance, the development of nanoscale transistors is enabling manufacturers to make smaller and smaller gadgets which can still store large amounts of data, perform at high speed, and communicate quickly. These devices are also more energy efficient and more secure as they employ magnetic random access memory (MRAM) based on nanometre‐scale magnetic tunnel junctions to quickly and effectively encrypt and back up data, even instantly prior to a systems failure or crash.

Elsewhere, nanoproducts are already being used in cutting-edge displays for laptops, TVs, smartphones, and digital cameras, all incorporating nanostructured polymer films known as organic light-emitting diodes, or OLEDs.

Making these nanoscale raw materials or having the patents for the processes involved is a growing business.

As research conducted by Industry Arc states, “The nanotechnology market size is forecast to reach $121.80 Billion by 2025, after growing at a CAGR of 14.3% during 2020-2025.”

While, a brief look at Zacks investment data for nanotechnology (from before the COVID pandemic) shows the nanoindustry, “… performing relatively well compared with the broader stock market over the past year. The S&P 500 returned nearly 27% in that period. Whereas nanotech’s return on investment was a slightly higher 28.5%.”

Adding that, “[The] disparity increases over a longer timeline. Over the last five years, nanotechnology stocks earned a whopping total return of 128% versus 73% for the S&P.”

Although the Investmentu website points out that the nanotechnology industry has, “… a relatively average price-to-earnings (P/E) ratio of 20.52.”

However, those that are concerned about stock market fluctuations, especially in these troubling times, may prefer to invest in something more robust.

In this respect, company bonds provide an opportunity to invest in a ‘bricks and mortar’ business.

Typical of industry’s advance into nanotechnology, is the Prague-based company AG CHEMI GROUP (who host this web page). With more than 25-years of experience in supplying raw materials and a long-established network of customers, AG CHEMI GROUP is well-placed to expand into the nanotechnology sector.

“There are now fixed plans to open a NANO DEVELOPMENT CENTER in Kladno, Czechia by the end of 2020,” explains Igor Sevcenko, the company’s founder and CEO.

The company has already established a portfolio of nanotechnology patents and nanoscale raw materials for industries as diverse as construction, the automobile sector, plastic production, and electronics.

The latest processes available even allow for increased recycling, as Lev Lyapeikov, the product development manager at AG CHEMI GROUP, explains, “Nanostructure technology allows 100% modification of secondary raw materials, both in order to maintain the conventional properties of materials at the required level (for example, impact strength) and in order to obtain new material properties (for example, obtaining thermally or electrically conductive plastics). Examples of the use of this technology can be found in our product portfolio and in our projects in the development and commercialization phase.”

To find out more about the company’s expansion plans, investment options and bond sales, please visit: AG CHEMI GROUP.

Photo credit: ThisIsEngineering from Pexels, Pexels, AGCHEMIGROUP, Pexels, & Jeremy Waterhouse from Pexels