Anyone involved in manufacturing, supplying or even using chemicals needs to be wary of how the industry is performing. There are a near-infinite number of influences on global basic chemical production, but by improving our understanding of the main factors, one can hope to have a better understanding of the chemical industry as a whole.

As discussed in part 1 of this two-part article, we have already learnt of the issues impacting the industry in Europe, the Middle East, and the USA. Here we continue by examining the factors leveraging the Chinese basic chemicals industry.

China

While the workshop of the world in the 21stcentury is still enjoying considerable growth and rising living standards, the manufacturing and chemical sectors, are facing serious challenges.

The biggest three being environmental concerns, manufacturing safety, and a tightening of investment finance.

Environmental Concerns

Since the 19th Central Committee in October 2017, President Xi Jinping, has stayed focused on the implementation of his ‘Blue Skies’ policy that aims to clean up industrial production. As a result, the condition of the environment is no longer sacrificed for the benefit of economic output.

As the chemical supplier ChemCeed, reported shortly after the Central Committee concluded its meeting, “In an effort to control air pollution, the Chinese Environmental Protection Ministry has cracked down on factories found to be in violation of emissions standards. Five companies in the Hebei province were reviewed for violations, and several chemical plants in the region are facing shutdown including well-known producers of chemicals such as Sebacic Acid and Dioctyl Sebacate. Exports from China on these materials are reportedly facing delays, and it is not known when production schedules will resume.”

Additionally, the online scientific journal, Futurism, understands that the level of closures have been even higher, reporting that, “China is in the midst of an all-out blitz on polluters flouting emissions standards, closing tens of thousands of factories in a massive effort to address the nation’s catastrophic pollution problems.

Estimates of the crackdown suggest as much as 40 percent of China’s factories have been temporarily closed by safety inspectors, with officials from more than 80,000 factories charged with criminal offences for breaching emissions limits over the past year.”

Such drastic action is certain to affect industrial capacity, especially the chemical industry which has a higher than average burden of toxic waste products.

Manufacturing Safety

Recent years have seen a number of deadly and highly publicised industrial accidents hit the chemical industry.

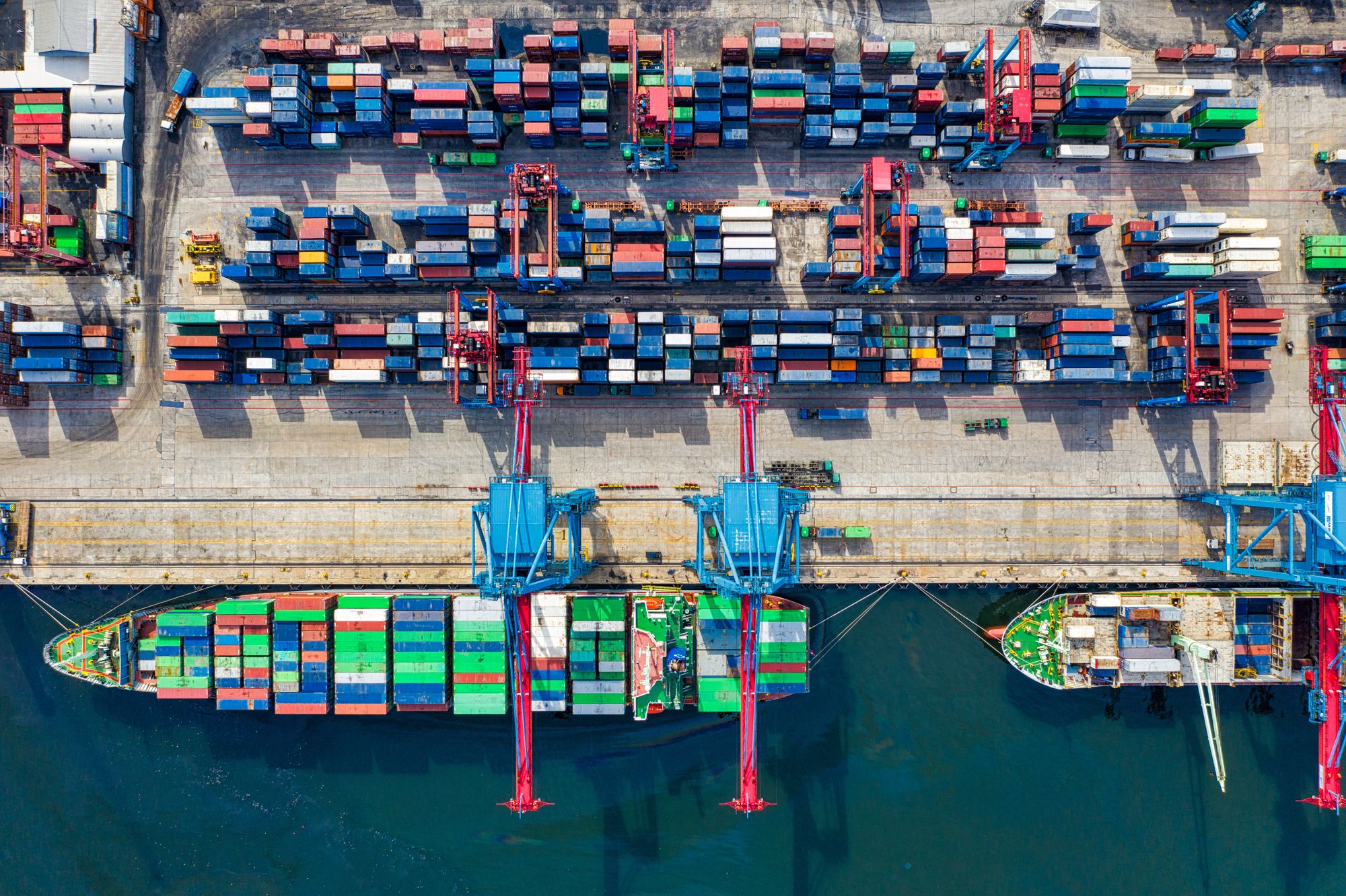

Most notably, the 2015 Port of Tianjin explosion which killed 173 people. The blast was caused by an overheated container of dry nitrocellulose which when it exploded ignited a further 800 tonnes of ammonium nitrate. Not only was a large area of the port devastated, but video footage of the blast made global news headlines.

While the accident led to prosecutions and an industry-wide clampdown on enforcing safety legislation, chemical industry accidents have continued, such as the April 2019 explosion which killed 47, at a chemical facility in Yancheng, run by Tianjiayi Chemical.

This has led to increased pressure on chemical producers to improve safety standards, while inspectors heighten their vigilance and impose ever-harsher penalties.

As the industry journal Chemical Watch reported at the time, “The Ministry of Emergency Management (MEM) will more strongly enforce its production ‘blacklist’. This exposes companies that have violated the production law and restricts them from establishing new projects, using land, as well as access to finance. Last year’s blacklist named 46 companies in China.”

Tightening of Investment Finance

Macroeconomic policy in China is currently limiting private investment across the entire country, harming the investment heavy chemical industry more than most.

As the latest data from McKinsey notes, there has been a noted fall in investment in the Chinese chemical industry. Their report stating that, “Annual chemical capital expenditures had risen rapidly in the 2010 to 2015 period, when China’s chemical demand was growing at more than 10 percent a year, more than doubling to reach 1.61 trillion renminbi in 2015. [However] Spending peaked in 2015 and fell back 7 percent, to 1.5 trillion renminbi, by 2017.”

This is of course alongside the tariffs imposed by the US as discussed in Part 1 of this analysis.

One example of the impact that tariffs are having on basic chemical supply is their effect on Chinese mono-ethylene glycols (MEG) prices and naphtha feedstock costs, which fell throughout April and May of 2019.

Much of this fall can be linked to US tariffs on Chinese clothing imports. As a recent ICIS report states, “If the Chinese economy slows as a result of a prolonged trade war, local spending on non-essential clothing will drop. You don’t buy a designer dress, or even a cheap shirt you don’t really need, if you we are worried about the future.”

Adding that, “… a prolonged trade war could hurt China’s overall textiles exports – the biggest in the world. World Trade Organisation data show China’s textiles exports totalled $110bn in 2017. In distant second place was the European Union at $69bn.

Combine this with a lack of real new economic stimulus in Q1 – and China’s limited capacity to stimulate the economy during the remainder of 2019 – and growth up and down the Chinese polyester value chain will likely fall short of expectations.”

While the report goes on to note a rise in MEG demand to 17m tonnes in 2019 from 16m tonnes in 2018, it also notes that, “The longer the trade war carries on, the more likely it is that we will have to downgrade this forecast. The same applies to our prediction that China’s polyester fibre demand will increase to 43.7m tonnes in 2019 from 41.4m tonnes in 2018.”

This final observation does much to sum up the situation across the global basic chemical industry. While short-term estimates are for steady growth, increased sales, and expanding output, there remains constant fear that things could go wrong.

The data from IHS Markit underlines this fact, estimating that, “ … total basic chemicals demand in 2018 increased to 515 million metric tons, a 20-million metric ton increase over 2017 total demand. The strongest growth (in 2018) was reported in the ethylene (8 million tons), propylene (5 million tons), benzene (1.6 million tons), and paraxylene (3 million tons) markets.” Yet adds to this optimism by stating that, “All four major regions are forecast to see a decline in profitability as oversupply in key markets forces chemicals and derivative prices lower in the face of steady or higher energy and feedstock costs.”

The ongoing trend of chemical industry growth fuelled by economic expansion in Asia and America and a rise in living standards in Africa and Latin America, is offset by outside influences. Yet the US/China trade war, a Brexit-created European recession, ever-stricter Chinese environmental restrictions, expanded sanctions against Russia, war against Iran, and any number of unforeseen geopolitical events could paint a much darker picture.

Photo credit: Chinadialogue, Essentialchemistry, Tankstoragemag, chemicalindustryjournal, China, Economist, & Timesofisrael