Corporate bonds have been around a long, long time.

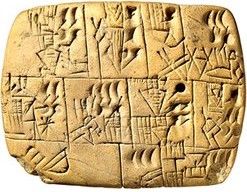

The earliest evidence is a stone tablet discovered in Nippur, in modern-day Iraq, which dates from 2,400 B.C. It records the payment of an amount of grain (the main trading currency at the time) with an assurance of a full reimbursement plus an excess (interest payment) by a certain date.

Governments later learned how to issue state bonds as a way of borrowing to fund wars. This began in Venice in the 1100’s with the issue of ‘presiti’, which could be traded for a profit or kept for an annual income.

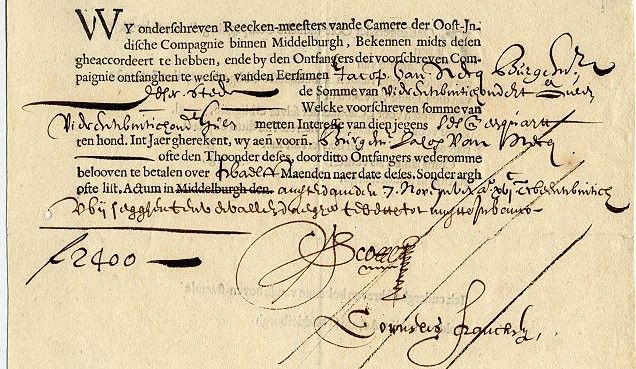

Modern corporate bonds began to be used when a formal banking system and corporate law was established in the Netherlands in the early 17th century. They were issued to finance the Dutch East India Company in 1623 and were the first of its kind to be issued to the general public for sale and trading.

However, it was the Bank of England which took bond issues to new levels, using them on a vast scale to finance the many wars against France. The success of the wars and the revenues gained by the investors secured the popularity of bonds among both sellers and buyers.

As companies began to take on bigger investment projects, building larger ships and trading outposts in the Americas, Africa, and Asia, corporate bonds were used to raise the finance needed. The profits made from importing exotic goods ensured that the interest on the bonds was paid, encouraging further bond issues.

Since those early days trading in grain, corporate bonds have become an essential investment tool for companies wanting to expand their business, diversify into new markets, or in creating new projects.

Bringing running water, electricity, gas, sewers, and phones to every home, for example, requires a huge investment in laying pipes and cables, and was possible by utility companies issuing corporate bonds.

Other major projects assisted by the sale of corporate bonds, include expansions to the railway network, bridges (the Golden Gate bridge was financed only from bond sales) power plants, reservoirs, and dams. Corporate bonds even helped finance Chinese economic reform in the early 1980’s. As the government restricted bank loans, businessmen were able to buy better factory machinery through bond sales to their employees.

Today, the bond market controls trillions of dollars’ worth of investment which funds new factories, drug research, the 5G network, or new oil pipelines. It also supports new markets, such as cloud computing or nanotechnology, providing benefits to businesses and consumers everywhere.

However, investors are also well rewarded with corporate bonds as an investment tool.

At the time of writing, a US Treasury 5-year government bond offers a yield of only 0.83% - not much better than a regular savings account. Meanwhile, corporate bonds frequently provide interest in excess of 5%.

Companies of all shapes and sizes issue bonds. Most notably, these include:

· Amazon - who raised $10 billion in a single bond issue. $1 billion of which was a 3-year bond with a record low of 0.4% interest.

· Microsoft – raised $20 billion in a 2017 bond sale, using the money to buy LinkedIn.

· New York’s World Trade Center – the landmark building was constructed thanks to funding from a 2014 bond issue worth $1.8 billion.

· Alphabet Inc. – Google’s parent company issued a $10 billion bond in 2020, including $1 billion’s worth of 5-year bonds which offered only 0.45%. Despite the low rate, demand outstripped supply three-fold.

· Alibaba – the Chinese retail giant raised $5 billion in funds from a bond sale issue in February 2021.

Clearly corporate bonds are still a go-to approach for businesses which want to raise capital. A simple solution for companies to fund the development of new products, the expansion into new markets, or the kickstart of projects that require long-term investment.

For individual investors they are a practical investment tool which provides regular payments as well as a full reimbursement when the bond matures.

Given these advantages, it seems that corporate bonds will remain successful for many years to come.

If you want to know more about investing in corporate bonds, then take a look at this investment calculator.

It shows the exact returns on corporate bonds issued by the Prague-based company AG CHEMI GROUP with an interest rate of 6.8%.

AG CHEMI GROUP (who support this website) is a supplier of industrial raw materials with more than 27 years of business experience. The company has now begun expanding into nanotechnology and nanomaterial solutions for manufacturing and is looking for investors to cooperate in this venture with the sale of corporate bonds.

To learn more about this expansion read: Investing in Czech Nanotech or A Nanotechnology Research Centre for Improving Plastics and Resins.

Photo credit: Jacob Cornelisz van Neck, pictavio from Pixabay, Bondfunds, Tracy Le Blanc & Tima Miroshnichenko from Pexels